Today?

Looks like stocks will finally leave the box

Unless you listen to Classic Vinyl on Sirius XM, you’ve either never heard of Jefferson Airplane or they’re lost in the fog of time. I actually had one of their posters on the wall when I was a little kid. Surrealistic Pillow was their most iconic album for its drug-infused White Rabbit sung by Grace Slick. But my brain was drawn to another track given the possibility that “stocks in a box” will finally take its place in the past when we close trading later. Airplane’s other primary vocalist, Marty Balin, wrote and sang Today, a tender ballad with guitar highlights provided by none other than Jerry Garcia, who was in the early days of launching the Grateful Dead at the time.

Today, I feel like pleasing you, more than before. Today, I know what I wanna do…

It’s taken so long to come true, and it’s all for you, all for you.

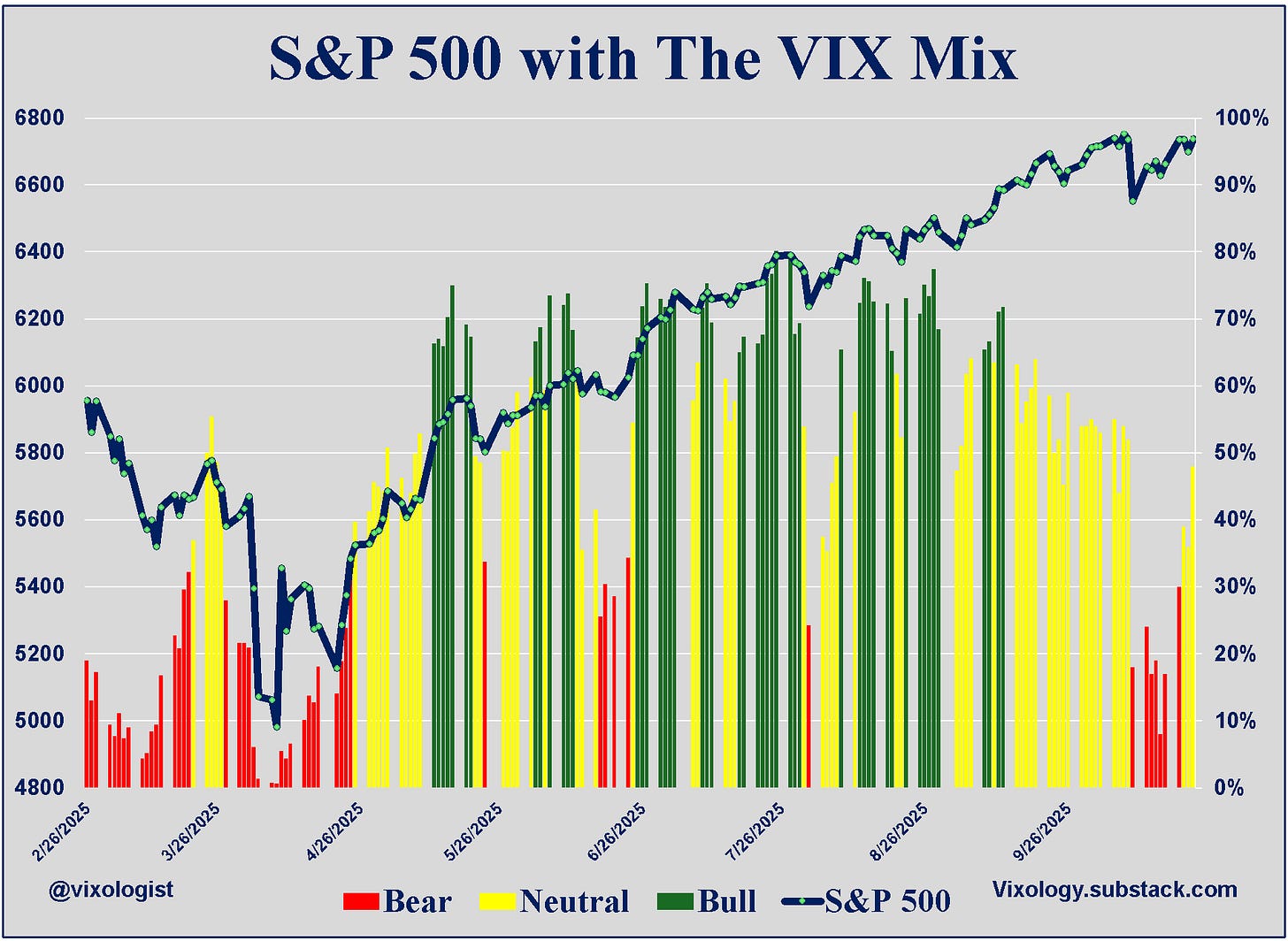

Do I really think the markets have any interest in pleasing me more than before? That would be a big NO, but it does appear that the bulls are reasserting themselves. Equity futures jumped after this morning’s release of CPI data and the S&P 500 is sitting above the high reached on 10/10 before that day’s collapse.

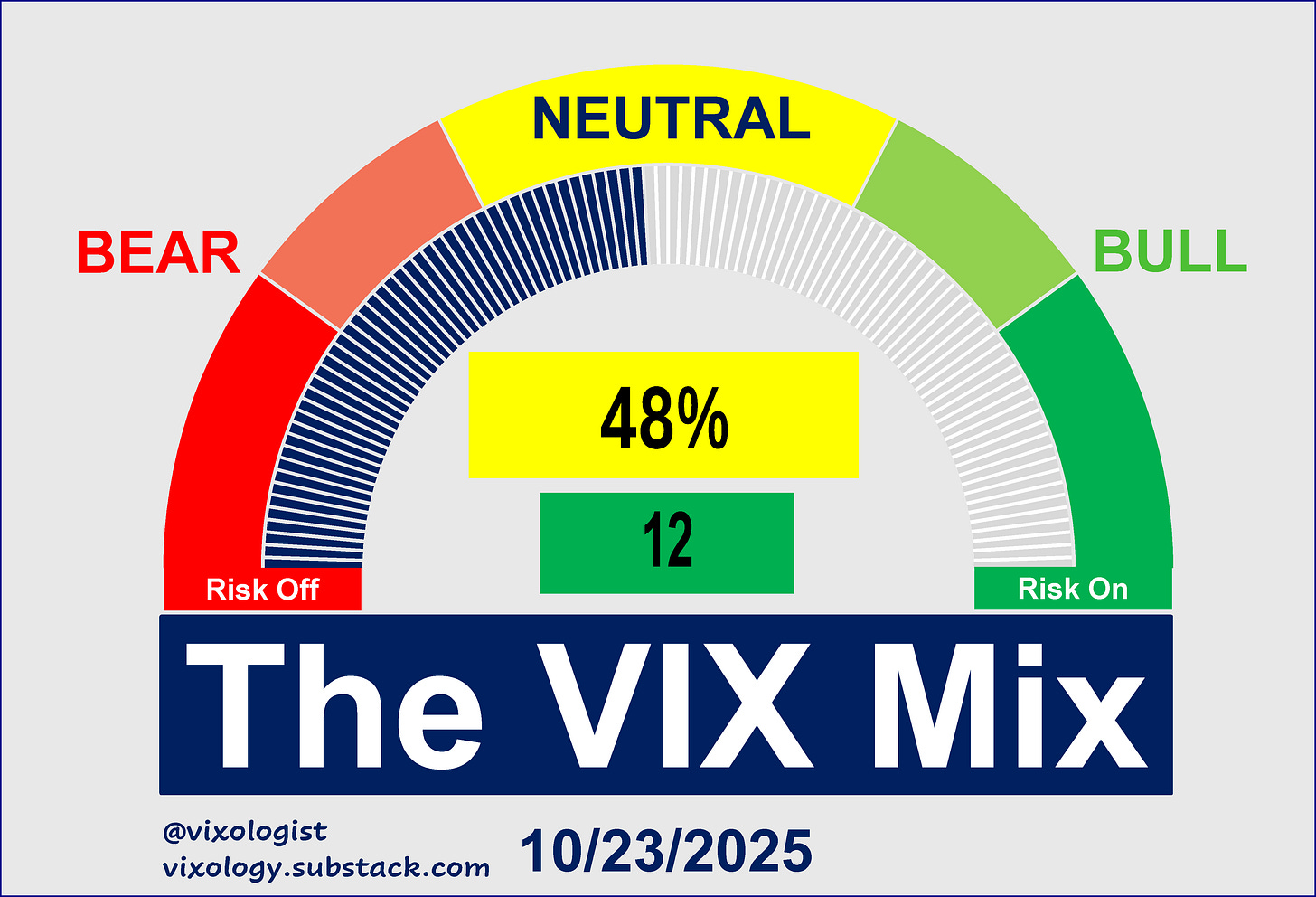

Volatility is contracting, as well. At yesterday’s close, our VIX Mix had rallied another 12 points and sat poised to cross above the 50-yard line.

Most of the underlying components are still stuck in neutral, but we now see three bullish and only four still bearish.

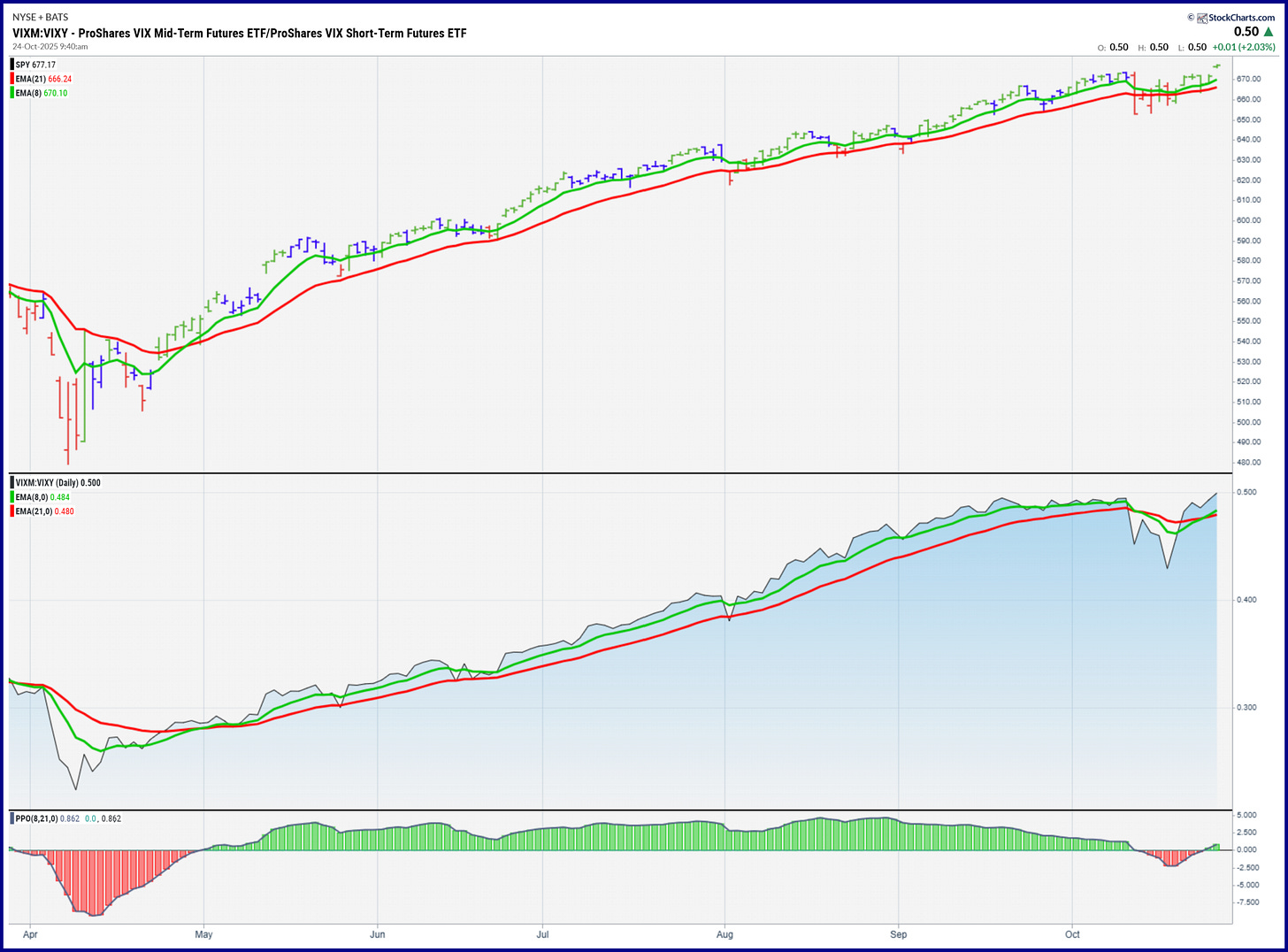

Markets continue to show two sides: harsh reactions to periodic punches in the face and the ability to shake it off and press higher. Another bullish signal coming from our volatility work is the recovery in VIX futures. This is our “old reliable” chart of the VIXM:VIXY ratio. It broke down on 10/10 but has recovered and is supportive of equities up and short vol. Not a recommendation. But good news for stocks, at least in the short term.

All content presented here is for informational and educational purposes only. Distribution of any content to any persons other than the recipient is unauthorized. Furthermore, any alteration of content presented here is prohibited. By accepting delivery of this presentation, the reader agrees to the foregoing. Certain information presented herein has been obtained from third-party sources considered to be reliable, but there is no guarantee of completeness or accuracy and it should not be relied upon as such. There is no obligation to update or correct any information presented. Readers should not treat any statement, opinion or viewpoint expressed herein as a solicitation or recommendation to buy or sell any security or follow any investment strategy. This material does not consider the investment objectives, financial situation, or needs of any particular reader. Readers should seek advice from a qualified financial or investment advisor prior to making any investment decision.

Martin Armstrong is says that 27 of October can be a significant day, according to his Socrates. Im 90% long, so I will be shorting some SVIX at closing today, if nothing else happens i take the loss monday night. Have a great weekend Jim !

Will Monday 27 October be the confirmation of a RED October for US markets ?

Short term yields, USD, and commodities ALL could fall.