Steady As We Go

Whose side are you on?

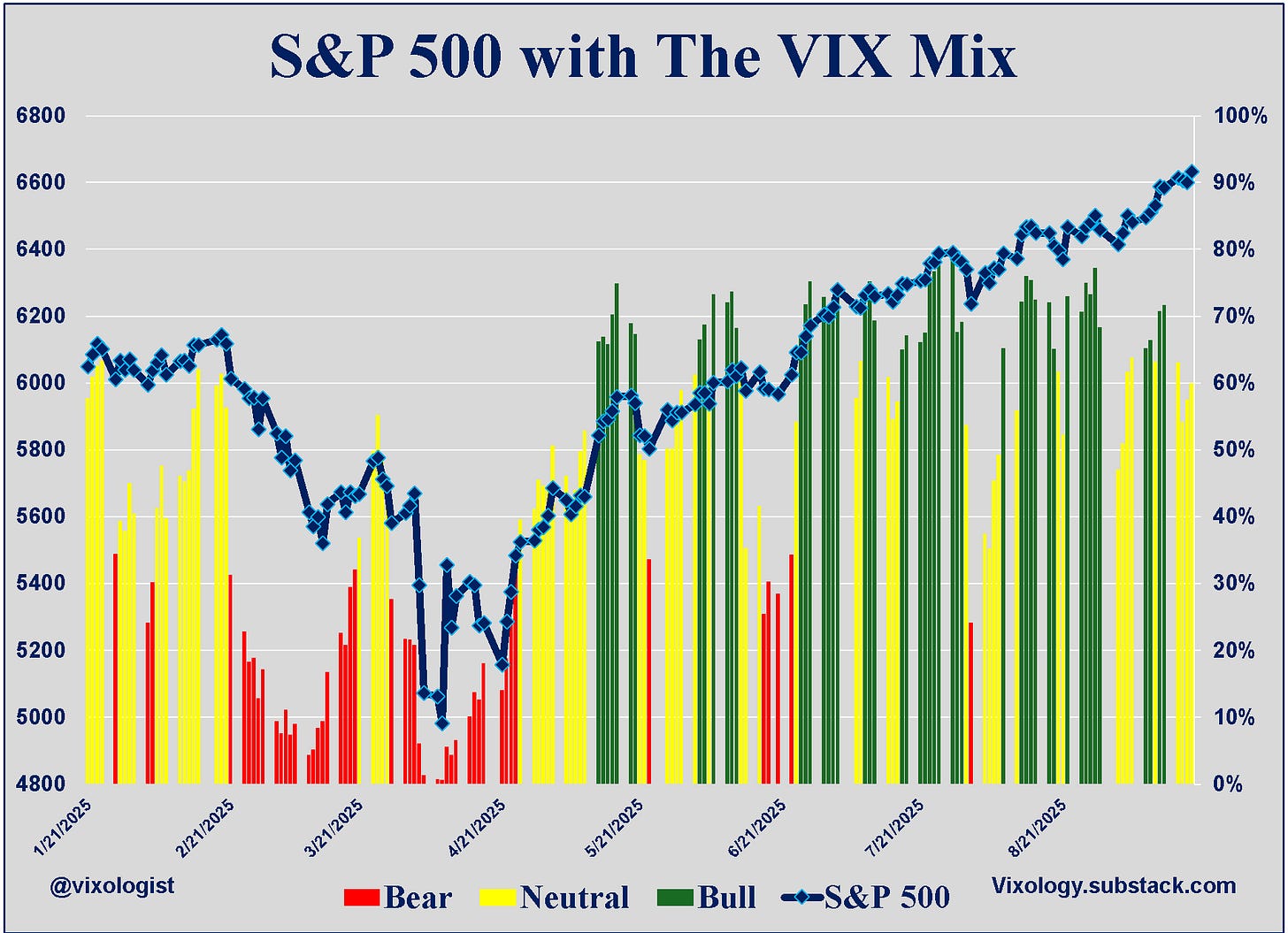

The “big” Fed meeting is now behind us without market disruption. Stocks continue their trend to new highs. Small caps are catching up. International equities are crushing the S&P 500 year-to-date. Bears are badly beaten and searching for a catalyst. It all adds up to “steady as we go” as a reasonable theme.

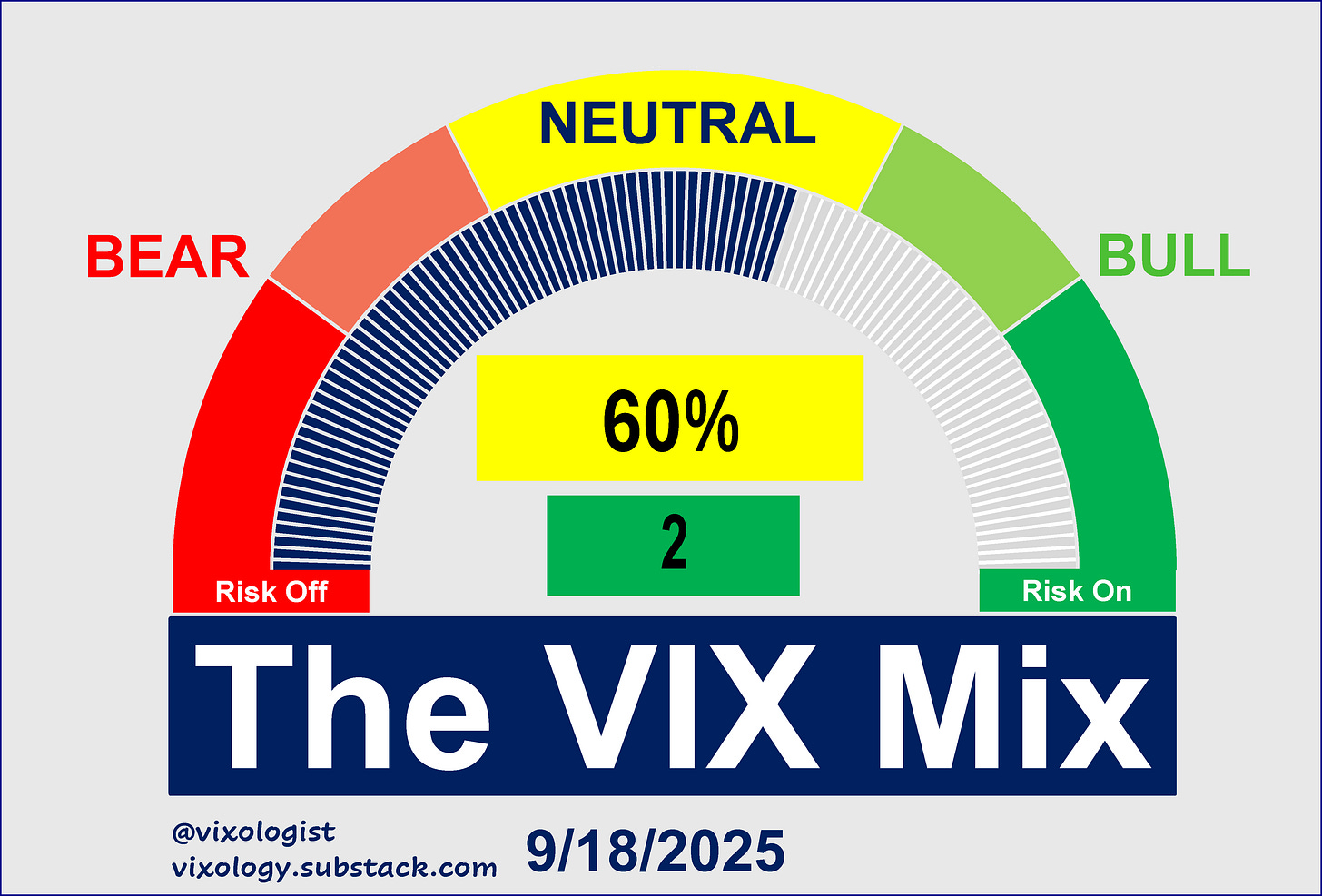

It would be nice to have the VIX Mix back at a bullish reading, but there is still some caution that accompanies being steady as we go. We made a little progress yesterday and could get back into the green with another good day or two.

Ten of the 17 components are on the bullish end and only two are bearish. The bull case for equities definitely needs the improvement to continue. A persistent divergence between all-time highs for SPX and neutral readings for VIX Mix would be a bad sign.

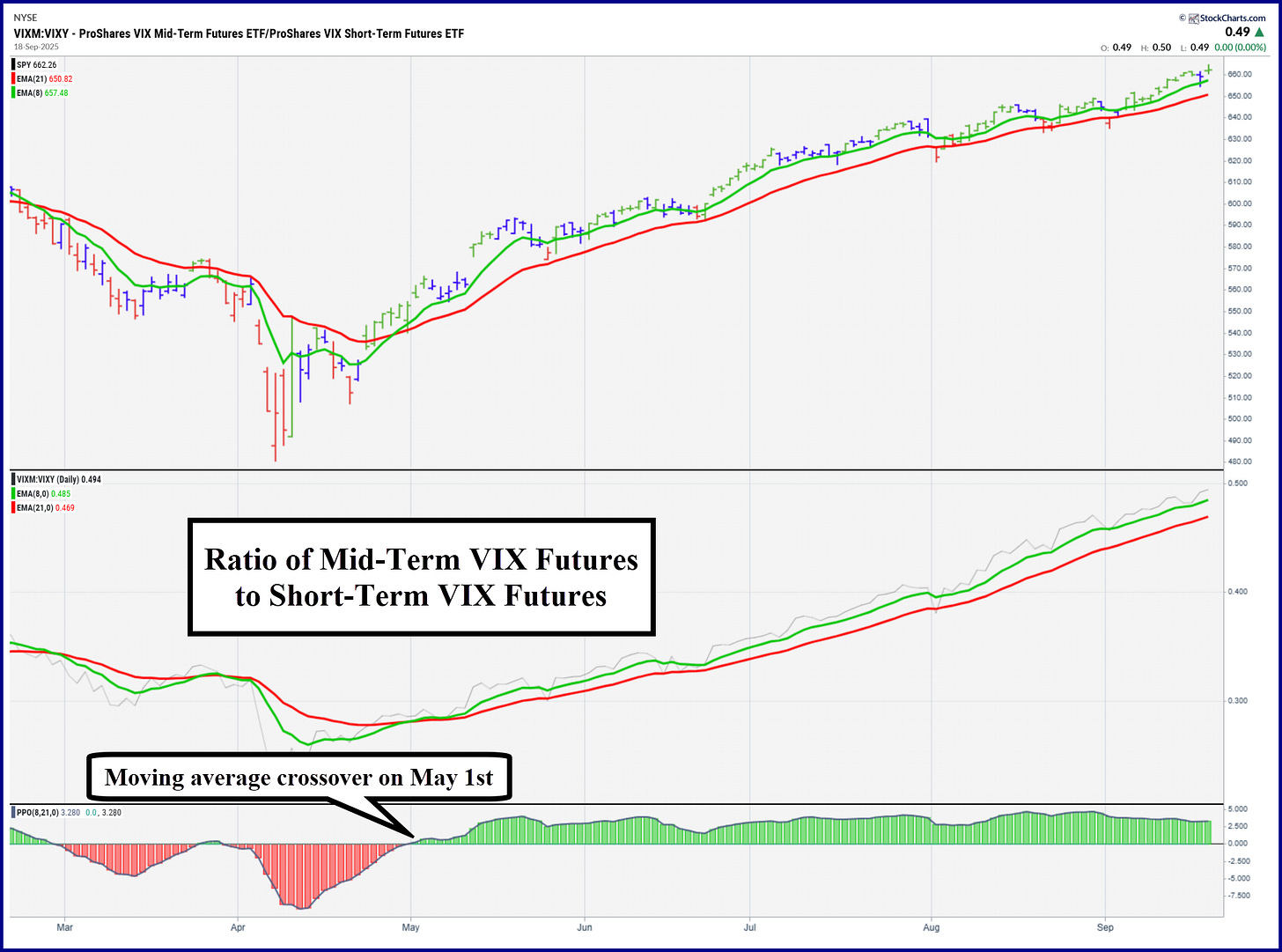

One of the indicators we pay close attention to is a derivative of the VIX futures term structure that looks at the ratio of mid-term futures (captured by the ETF $VIXM) and short-term futures (captured by $VIXY). We take the ratio and filter the daily noise with 8-day and 21-day exponential moving averages and plot crossovers. As shown below, the most recent cross was back on May 1st and that bullish condition has not wavered since then. You can see in the top pane that the 8/21 crossover on SPX came at the same time (actually a day earlier). We would not recommend this as a stand-alone trading signal, but it’s pretty useful to know if you’re in the green or the red. For the moment, it’s steady as we go.

All content presented here is for informational and educational purposes only. Distribution of any content to any persons other than the recipient is unauthorized. Furthermore, any alteration of content presented here is prohibited. By accepting delivery of this presentation, the reader agrees to the foregoing. Certain information presented herein has been obtained from third-party sources considered to be reliable, but there is no guarantee of completeness or accuracy and it should not be relied upon as such. There is no obligation to update or correct any information presented. Readers should not treat any statement, opinion or viewpoint expressed herein as a solicitation or recommendation to buy or sell any security or follow any investment strategy. This material does not consider the investment objectives, financial situation, or needs of any particular reader. Readers should seek advice from a qualified financial or investment advisor prior to making any investment decision.