One down, one to go

Nvidia is the next big known unknown

We suspected that Jay Powell’s speech at Jackson Hole was going to be a binary event. If viewed positively, markets would rocket higher. If he came across as hawkish, markets would drop hard. We saw the signs that investors were hedging in advance. The second order question: Do markets follow through in whatever direction they went after the talk? Yesterday’s answer was “Meh” - let’s not get carried away. Equity markets backed off a bit and the biggest winner on Friday (small caps) was the biggest loser yesterday. Not necessarily a big deal, but important to watch.

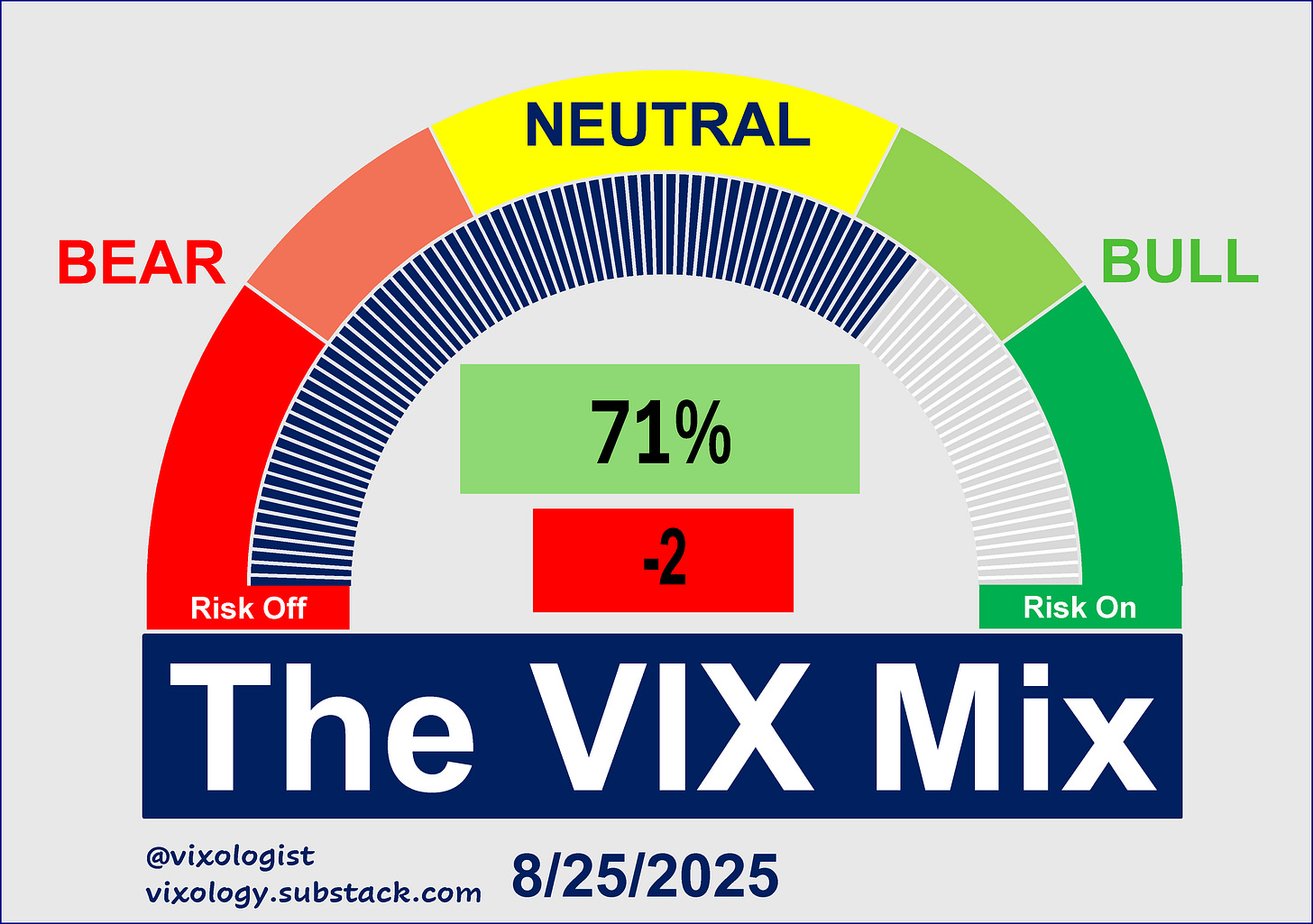

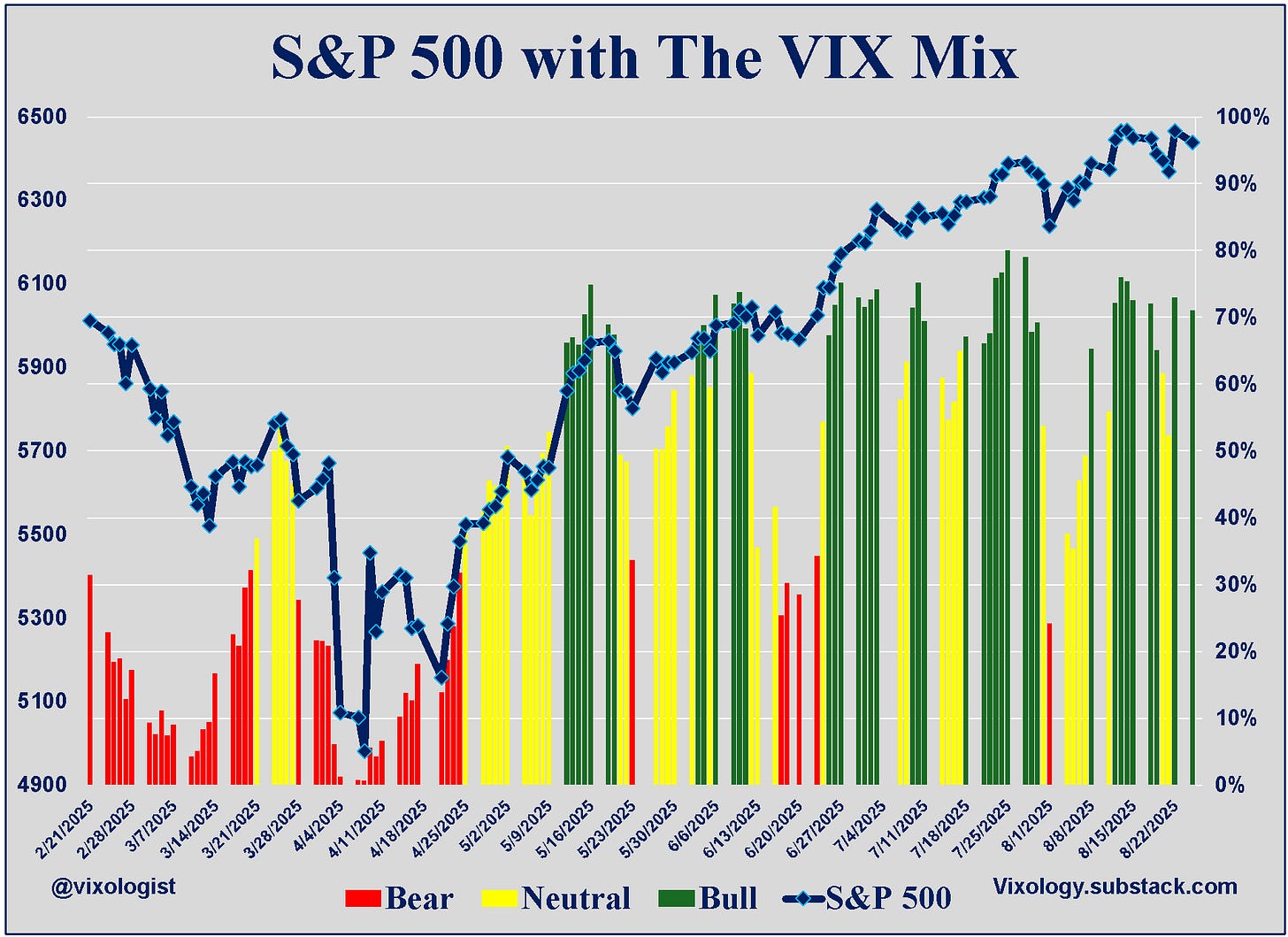

The VIX Mix also pulled back a hair yesterday. Not much, but no follow through on the 21 point jump from Thursday to Friday.

As shown below, overall volatility conditions remain bullish. As we noted over the weekend, the other big “known unknown” currently in focus is tomorrow’s earnings report from Nvidia that will arrive after the close. This is certainly one reason that Friday’s enthusiasm would be tempered.

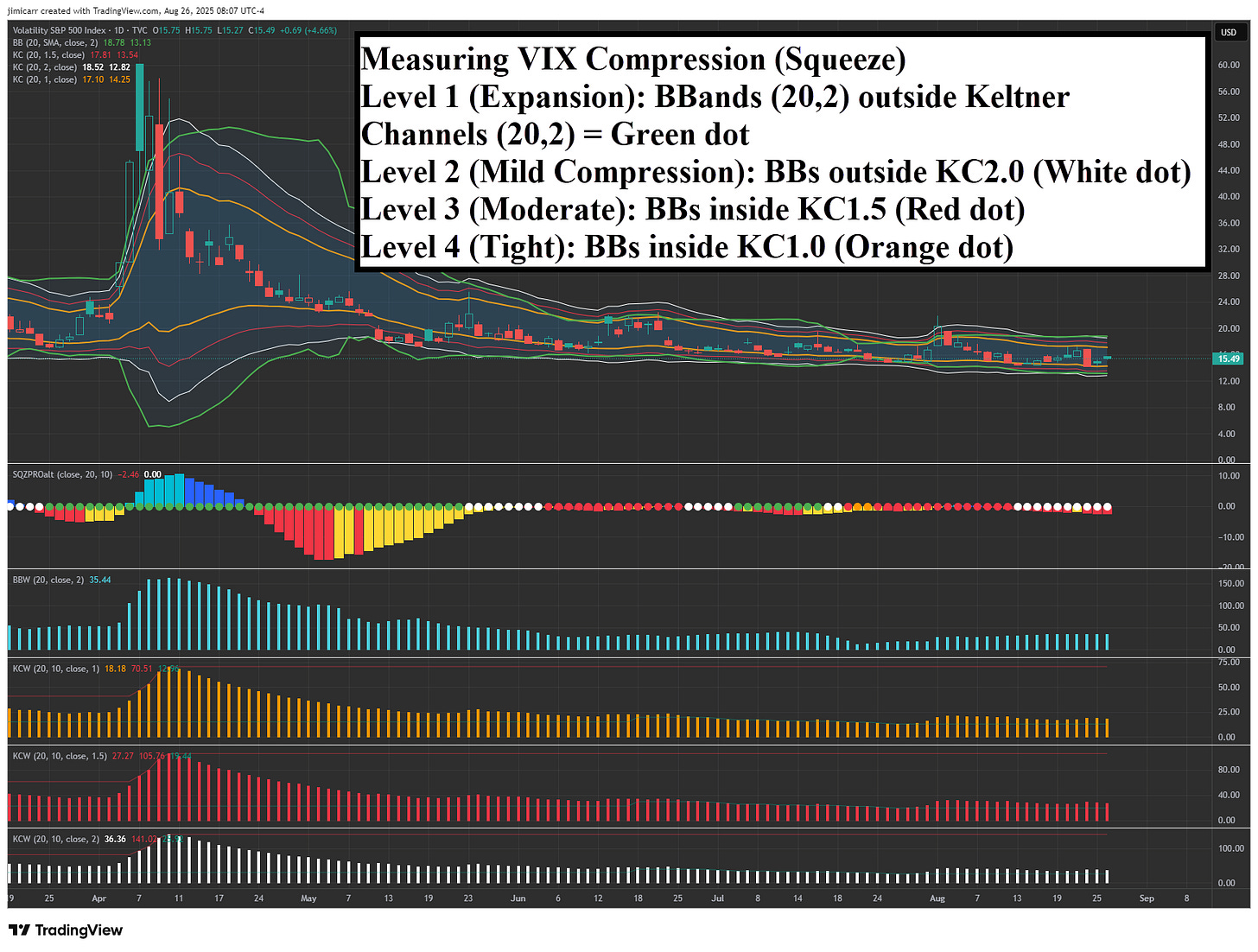

It’s been a minute since we offered up a status report on the VIX squeeze. The chart below includes a description of the four levels we use to characterize the strength of the squeeze. You can see that we are in a mild compression right now. The clock is still ticking on a determined breakout from the range we’ve been in for a month.

For those who may not now, I will be appearing tomorrow morning with Dale Pinkert from ForexAnalytix to talk about my current view of the markets. It will air live at 8:30 EDT and you can register using this link. Now I need to run off and figure out what I’m going to talk about. 😉