Here we are in mid-July and markets certainly have a mellow vibe. Plug “Lazy Sunday” into Spotify and you have several song choices that span genres and time periods. My inspiration for this search was last night’s viewing of 50 Years of SNL Music that included the original Lazy Sunday sketch by Chris Parnell and Andy Samberg. IMO, the SNL Show is must-see TV. I lost count of the flashbacks I experienced.

The initial search also produced the original Small Faces (Steve Marriott and Ronnie Lane before Rod Stewart), The California Honeydrops, and Freddie Mercury crooning from A Night At The Opera. But the easter egg in the list for me was a jazz instrumental from Duncan Lamont, a Scottish born saxophonist and bandleader who composed this take on Lazy Sunday that really nailed the mood for me.

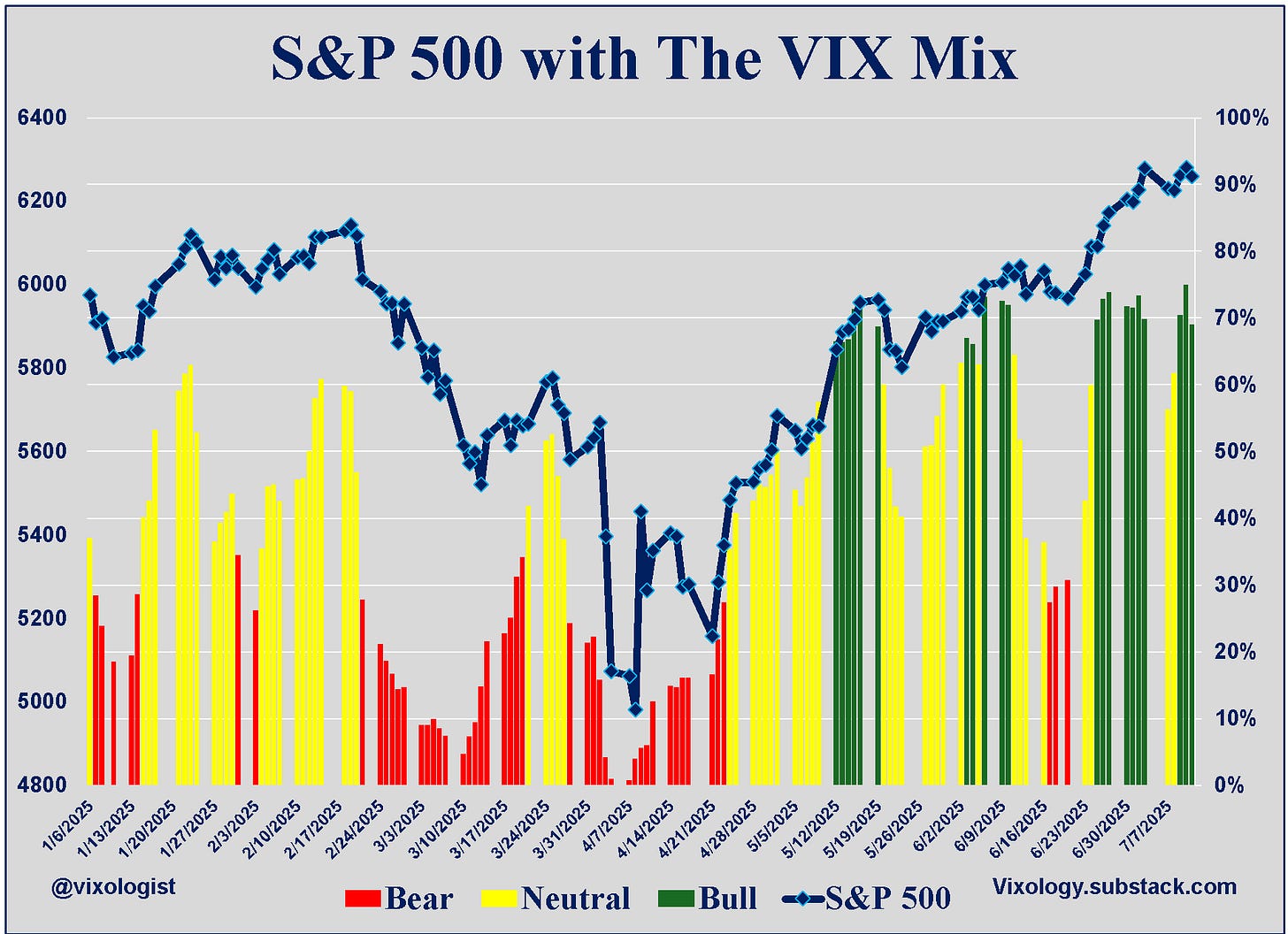

Anyway, last week was relatively uneventful across the volatility “complex.” The VIX Mix finished the week at 69% (bullish) with three of the five days in the green.

Glancing down the weekly recap, most of the volatility measures were little changed. VIX, VVIX, VOLI and TDEX (tail risk) were pretty much flat and the 17.79 high for VIX was last Monday - not surprising after a 3-day weekend.

The most significant change for the week was at the front end of the VIX futures term structure. We mentioned this a couple of times. Two elements to this. First, spot VIX was essentially unchanged from July 3rd to July 11th. Second, the July VIX futures contract will expire this coming Wednesday morning with a final settlement equal to spot VIX. That creates a “magnetic” pull between the two. With spot VIX “stuck” just above 16, the premium between the July futures contract and spot VIX contracted from almost two points to roughly .7 points. As noted in the recap above, the combination of contango and the dropping term structure gave a boost to the short volatility ETFs.

So we’ve got a lazy Sunday in July and the bulls are feeling comfortable. All of this may continue through the rest of the summer. But August makes me nervous. I remember 2011, 2015 and 2024. We no longer have VIX in a squeeze (see below), but a closer look reveals that while the Bollinger Bands have widened outside the Keltner Channels, the KCs have actually tightened. It would not be surprising to see the squeeze condition return and with it the potential for something to disrupt the current summer doldrum. It may not happen, but you can’t be surprised if it does.

All content presented here is for informational and educational purposes only. Distribution of any content to any persons other than the recipient is unauthorized. Furthermore, any alteration of content presented here is prohibited. By accepting delivery of this presentation, the reader agrees to the foregoing. Certain information presented herein has been obtained from third-party sources considered to be reliable, but there is no guarantee of completeness or accuracy and it should not be relied upon as such. There is no obligation to update or correct any information presented. Readers should not treat any statement, opinion or viewpoint expressed herein as a solicitation or recommendation to buy or sell any security or follow any investment strategy. This material does not consider the investment objectives, financial situation, or needs of any particular reader. Readers should seek advice from a qualified financial or investment advisor prior to making any investment decision.