Friday the 13th

The first of two this year

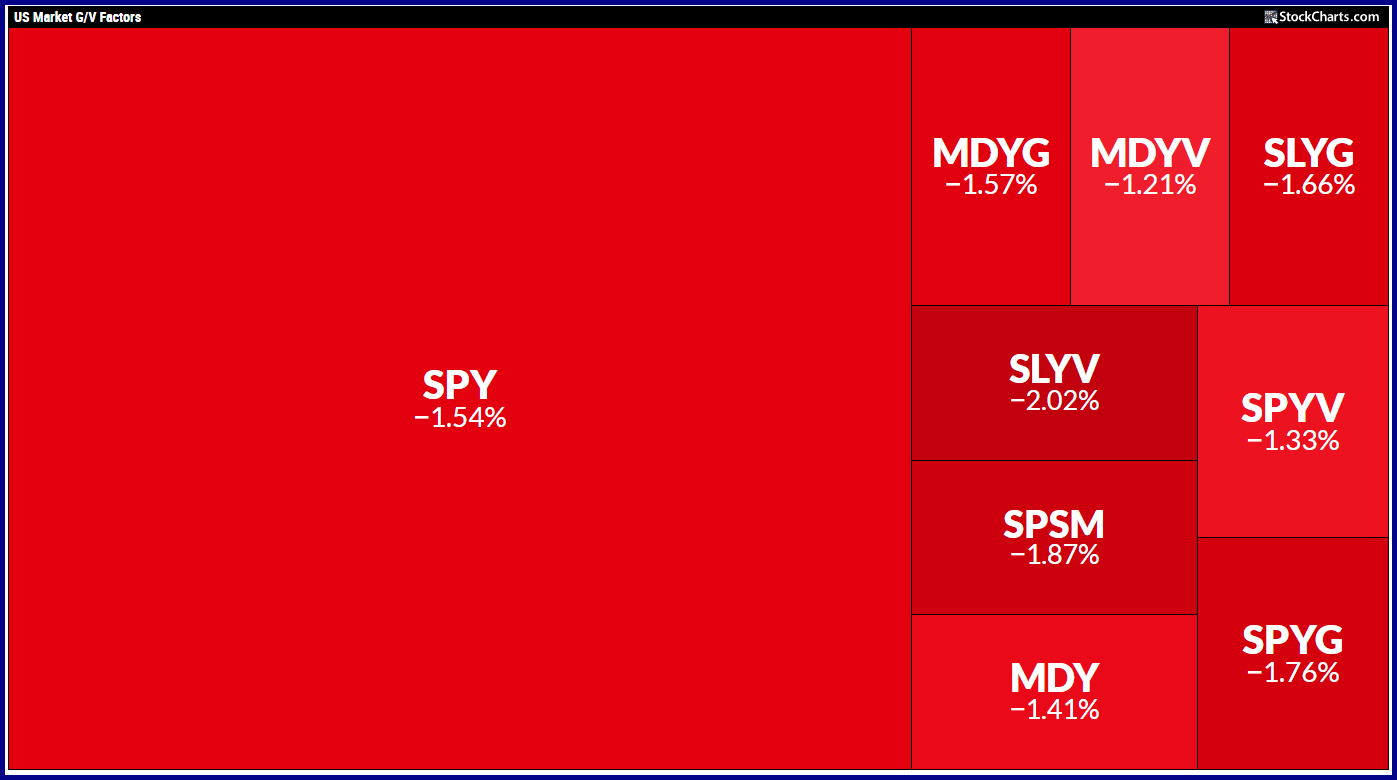

Wow! Large cap, mid cap, small cap and both flavors of growth and value. These common categories provided nowhere to hide yesterday.

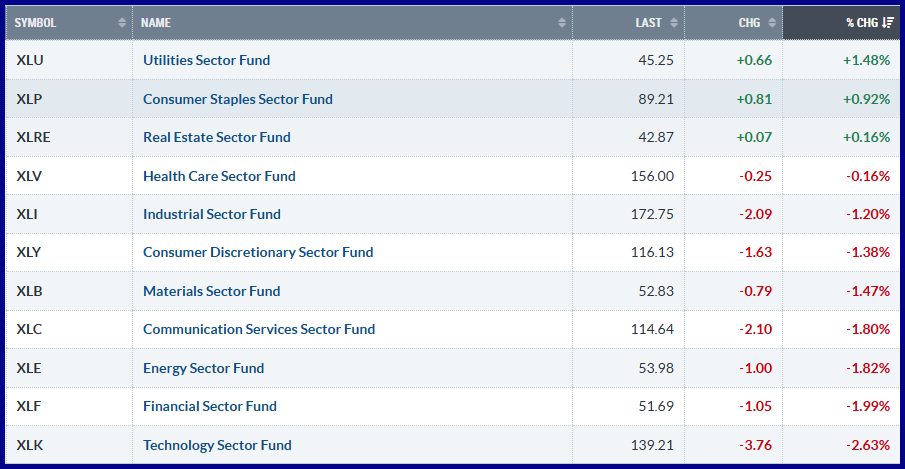

Only three of eleven US sectors finished in the green and seven were down more than 1% on the day.

Headlines shouted that the grim reaper of AI had taken down the transportation sector after a former karaoke company launched an AI logistics tool in a drive-by shooting reminiscent of the DeepSeek announcement last year.

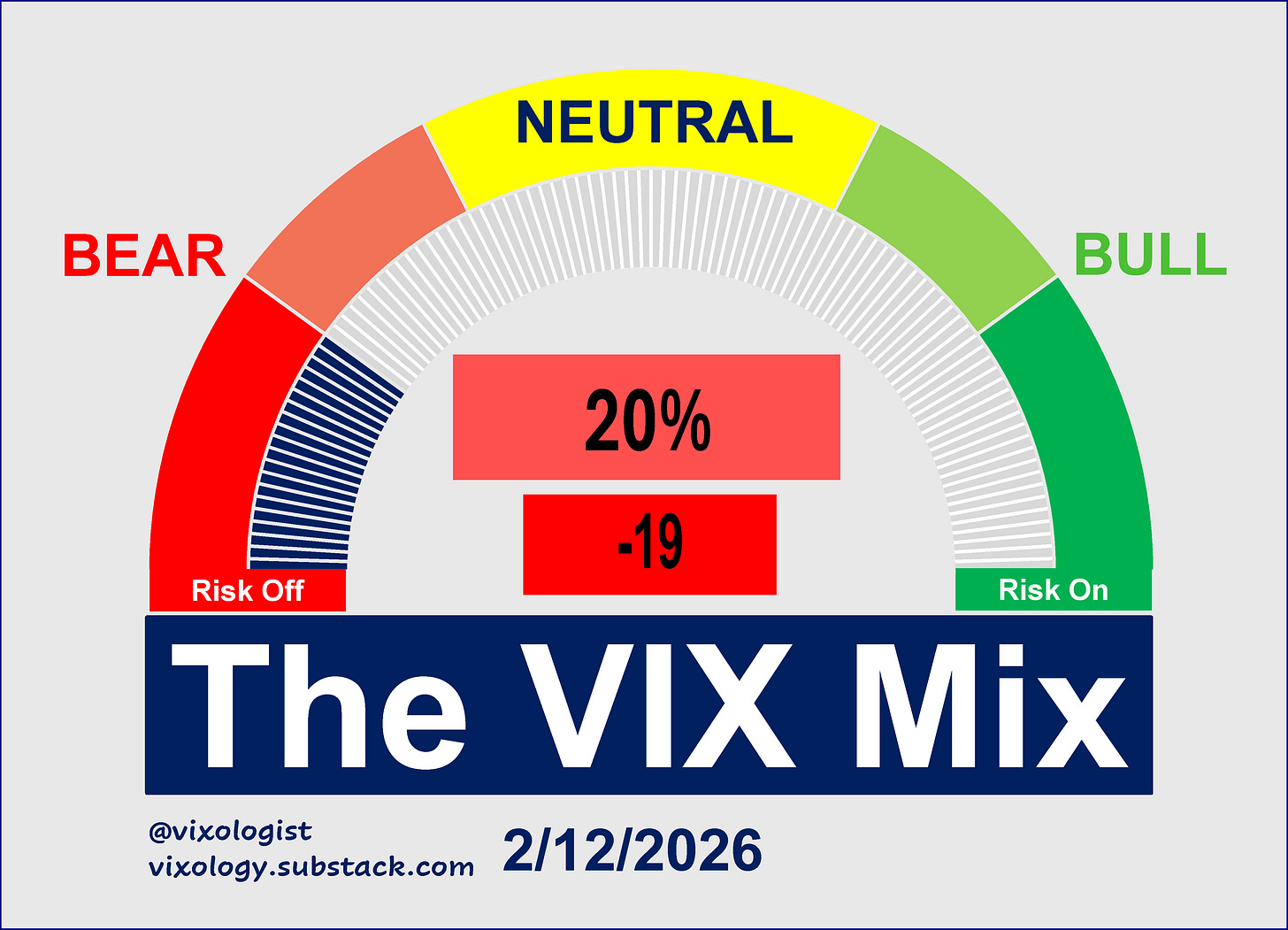

No shock that the VIX Mix took it on the chin. Down 19 points to land at 20%, right on the border of bad and worse. There were no components on the bullish end and 15 of 17 were in one of the red segments of the gauge.

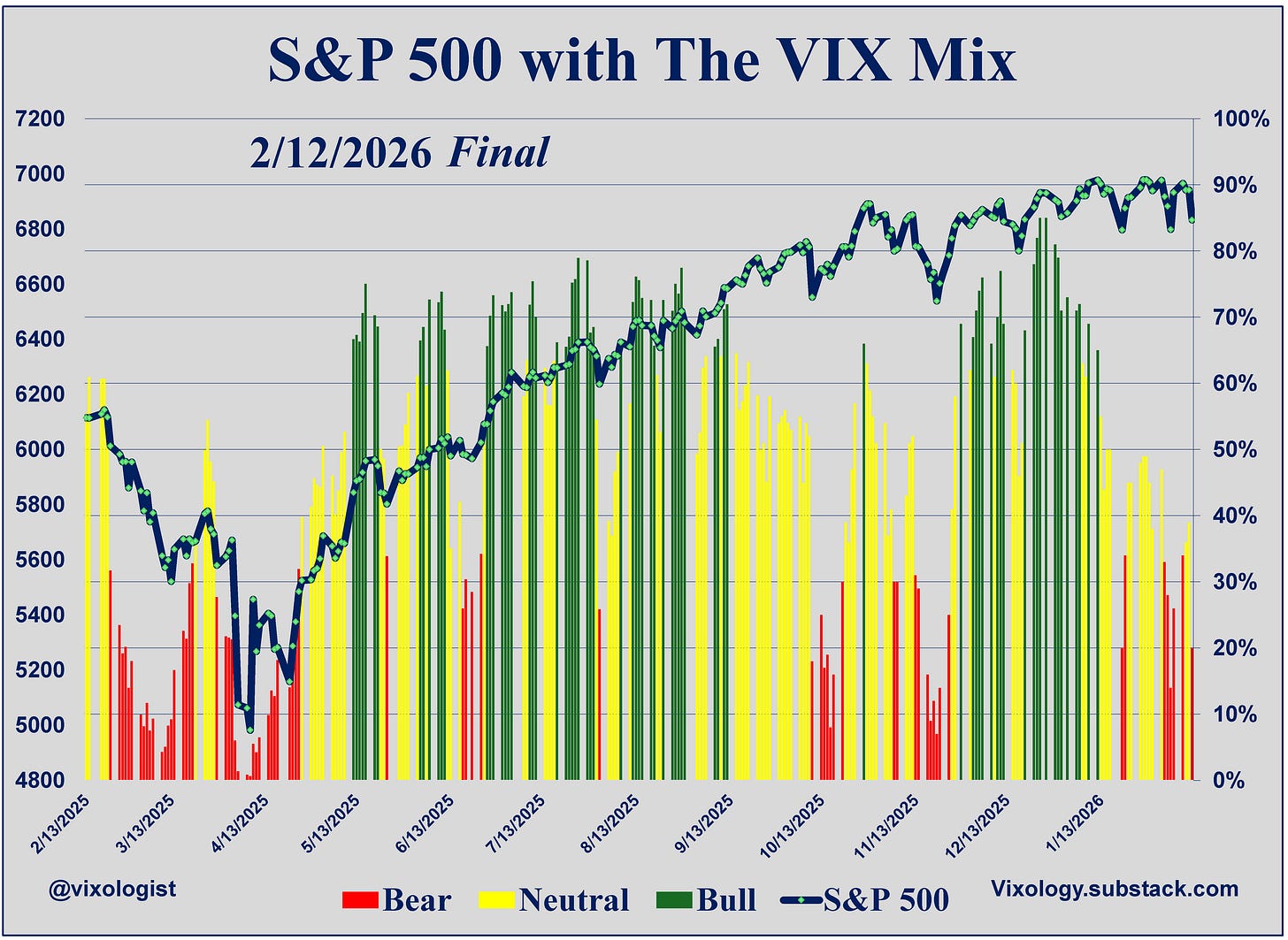

It’s as if the bears show up every time the S&P 500 knocks on the door of 7000. And dip buyers have stepped in every time since we recovered from last year’s Tariff Tantrum.

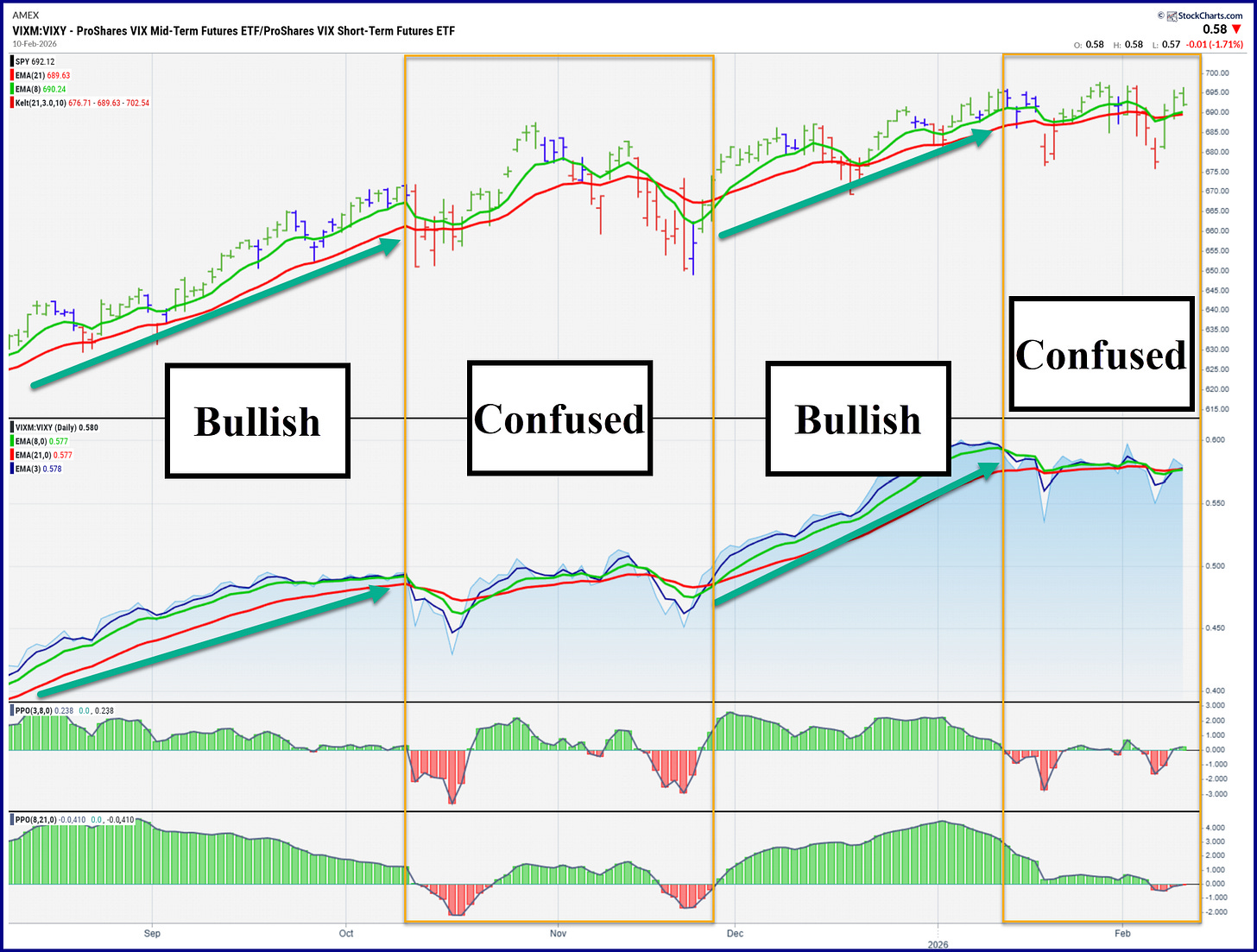

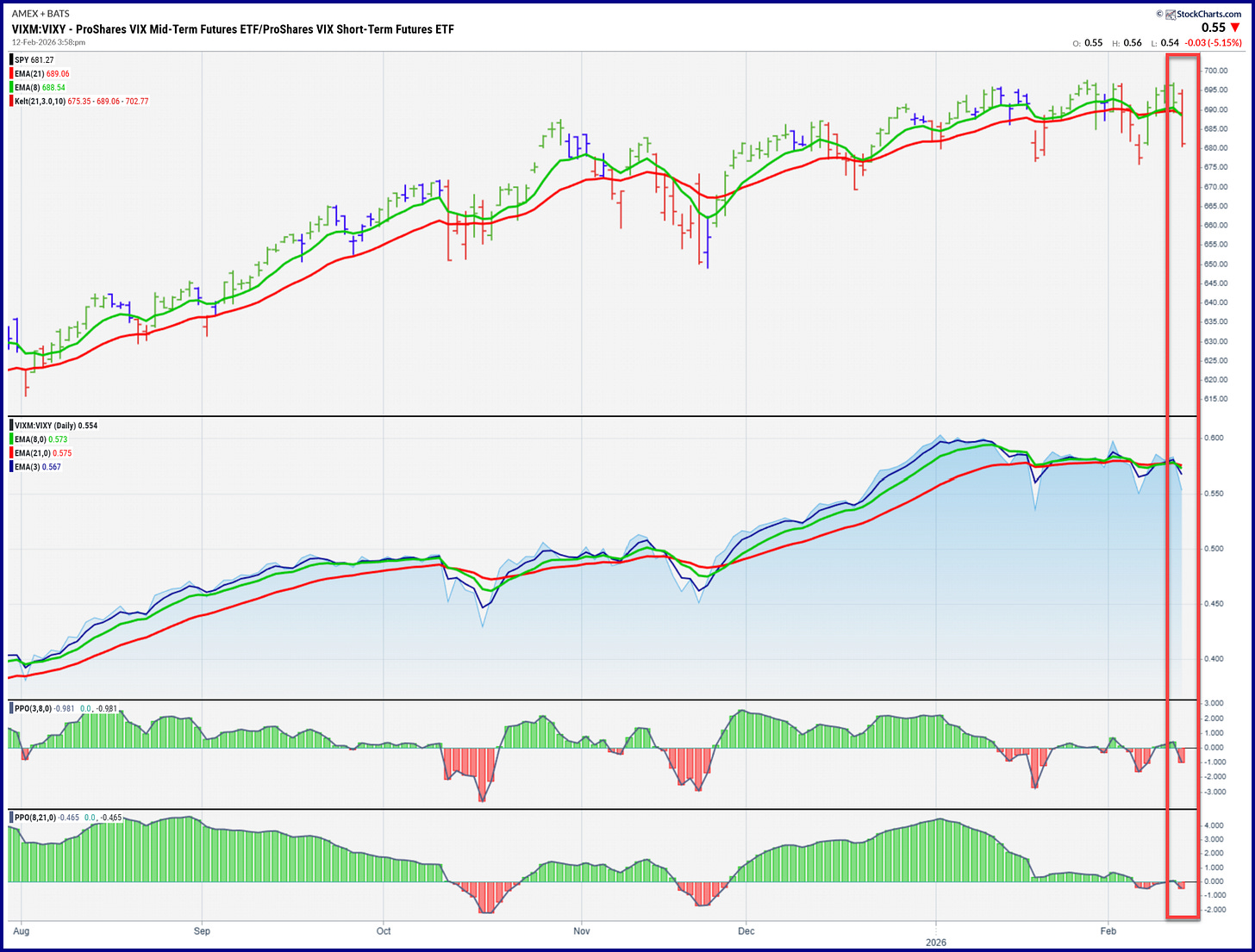

We posted the chart below just a couple of days ago (Confused - But not dazed). As a reminder, it shows the ratio of VIXM:VIXY as a proxy for bullishness and bearishness in the VIX futures term structure. The third category is “confused.”

After yesterday’s blood bath, the ride edge of the chart is bearish once again. You can see the head fakes back in October and November.

No one has a clue how this move will work out. Markets have been very resilient and bears have been repelled. The VIX Mix is telling us that investors have not allowed themselves to be fully bullish, but hedging has not paid off except for the most nimble of traders. I suspect that some measure of battle fatigue may be setting in. Should this dip turn in to something deeper, we may see a more meaningful correction. Everyone should take minute to decide what kind of response makes sense given individual timeframe and risk tolerance.

All content presented here is for informational and educational purposes only. Distribution of any content to any persons other than the recipient is unauthorized. Furthermore, any alteration of content presented here is prohibited. By accepting delivery of this presentation, the reader agrees to the foregoing. Certain information presented herein has been obtained from third-party sources considered to be reliable, but there is no guarantee of completeness or accuracy and it should not be relied upon as such. There is no obligation to update or correct any information presented. Readers should not treat any statement, opinion or viewpoint expressed herein as a solicitation or recommendation to buy or sell any security or follow any investment strategy. This material does not consider the investment objectives, financial situation, or needs of any particular reader. Readers should seek advice from a qualified financial or investment advisor prior to making any investment decision.

Thank you for the simple mans explanation of things. 🙏

Can't watch the market full time, so just have to ride it out. Still carrying some cash to deploy on 10 to 20% pullbacks... and then just have to ride that out as well. yippee.