Canaries

But is there methane in the coal mine?

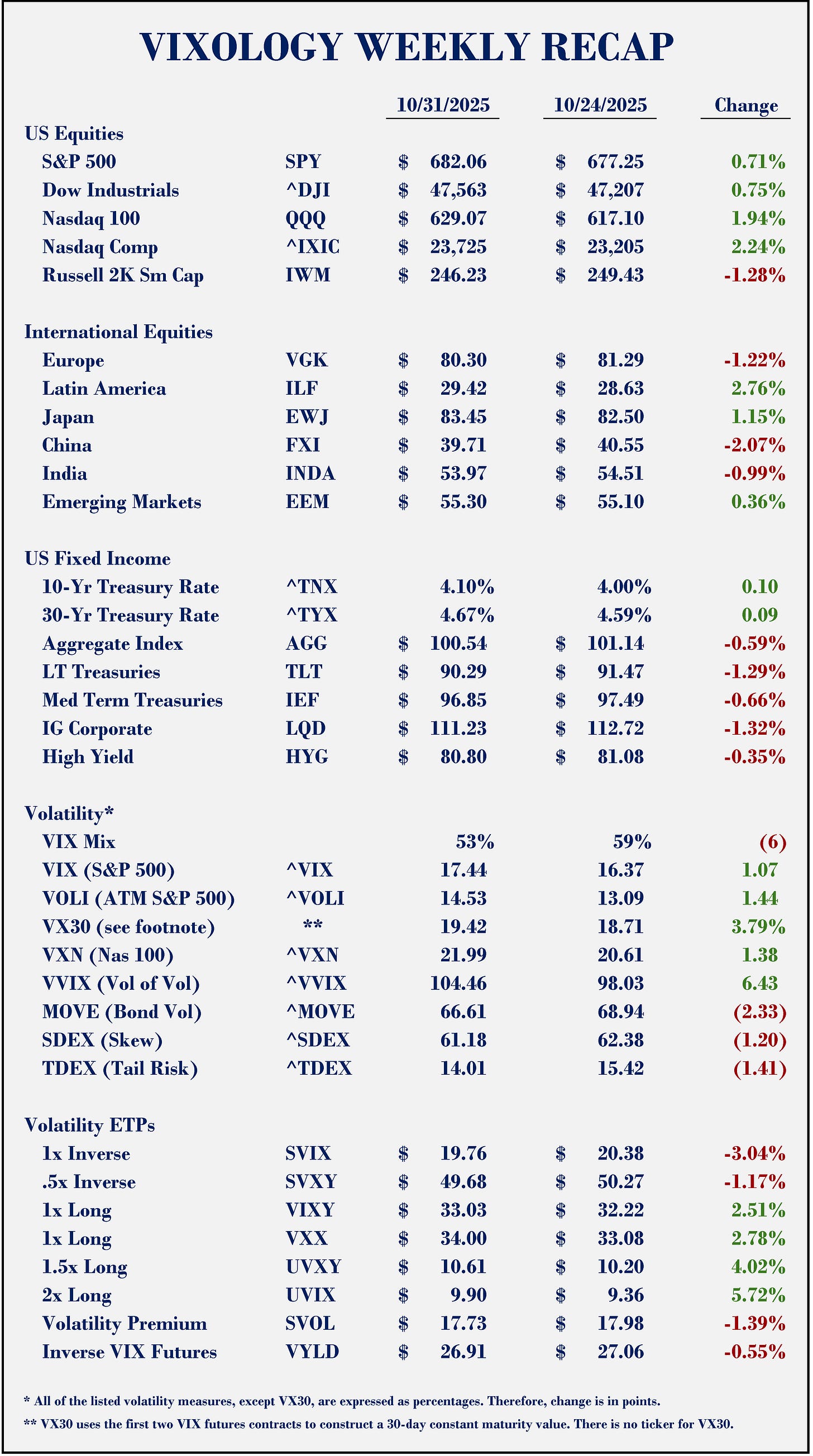

What’s wrong with the stats shown below in the weekly recap?

Large cap US stock indices finished the week higher but implied volatility (VIX/VOLI) was also higher and short vol (SVIX) went the “wrong” direction.

The Fed cut its funds rate by 25 basis points but longer-term Treasury rates moved higher and bond prices went down.

It’s just one week, so we can’t get carried away. But we also need to pay attention.

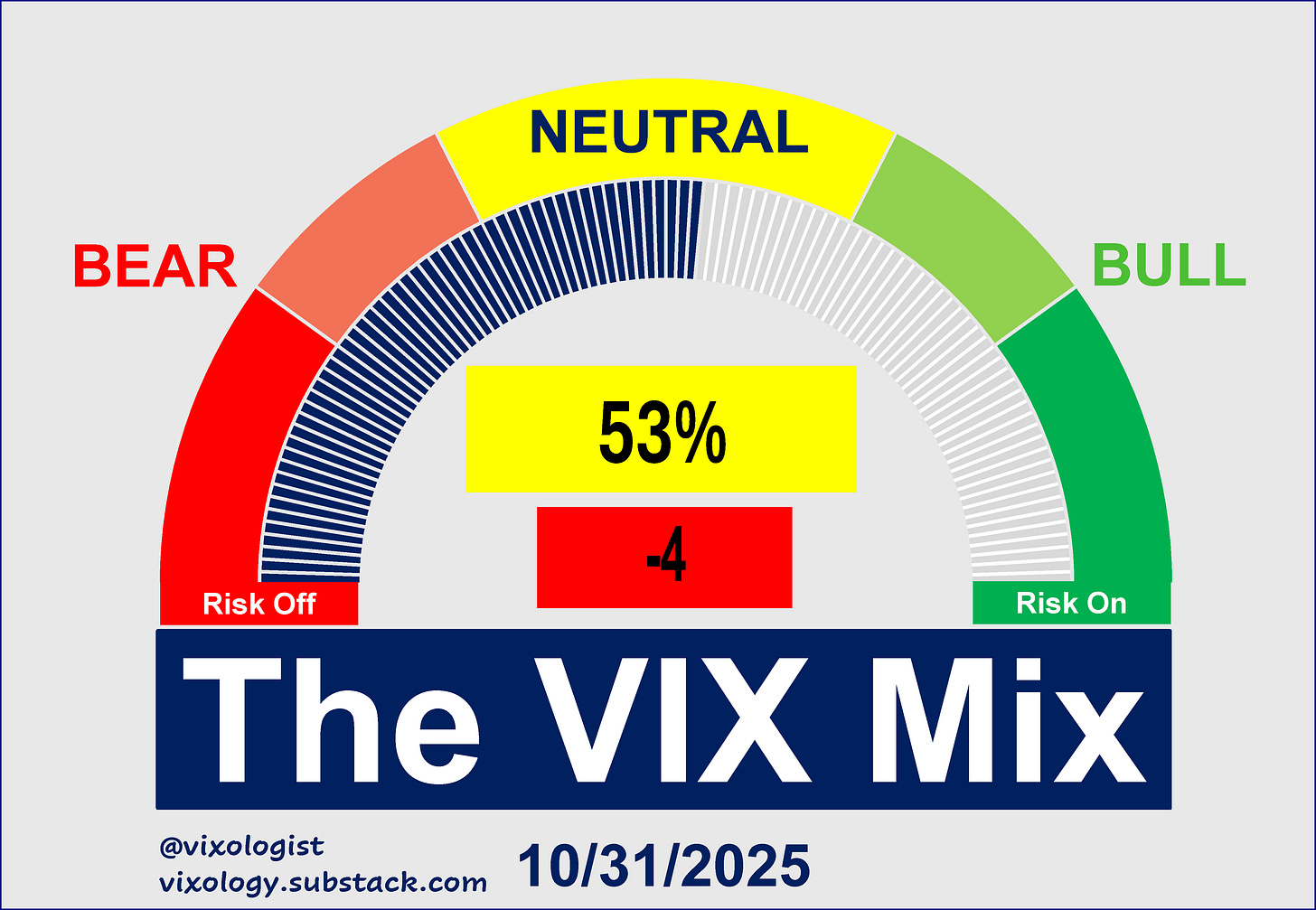

You can also see in the table above that the VIX Mix gave up six points week over week. Bullish components dropped from ten to four, though the bearish count was pretty steady moving from 4 down to 3.

We had two green shoots to start the week but retraced the last three days of the week.

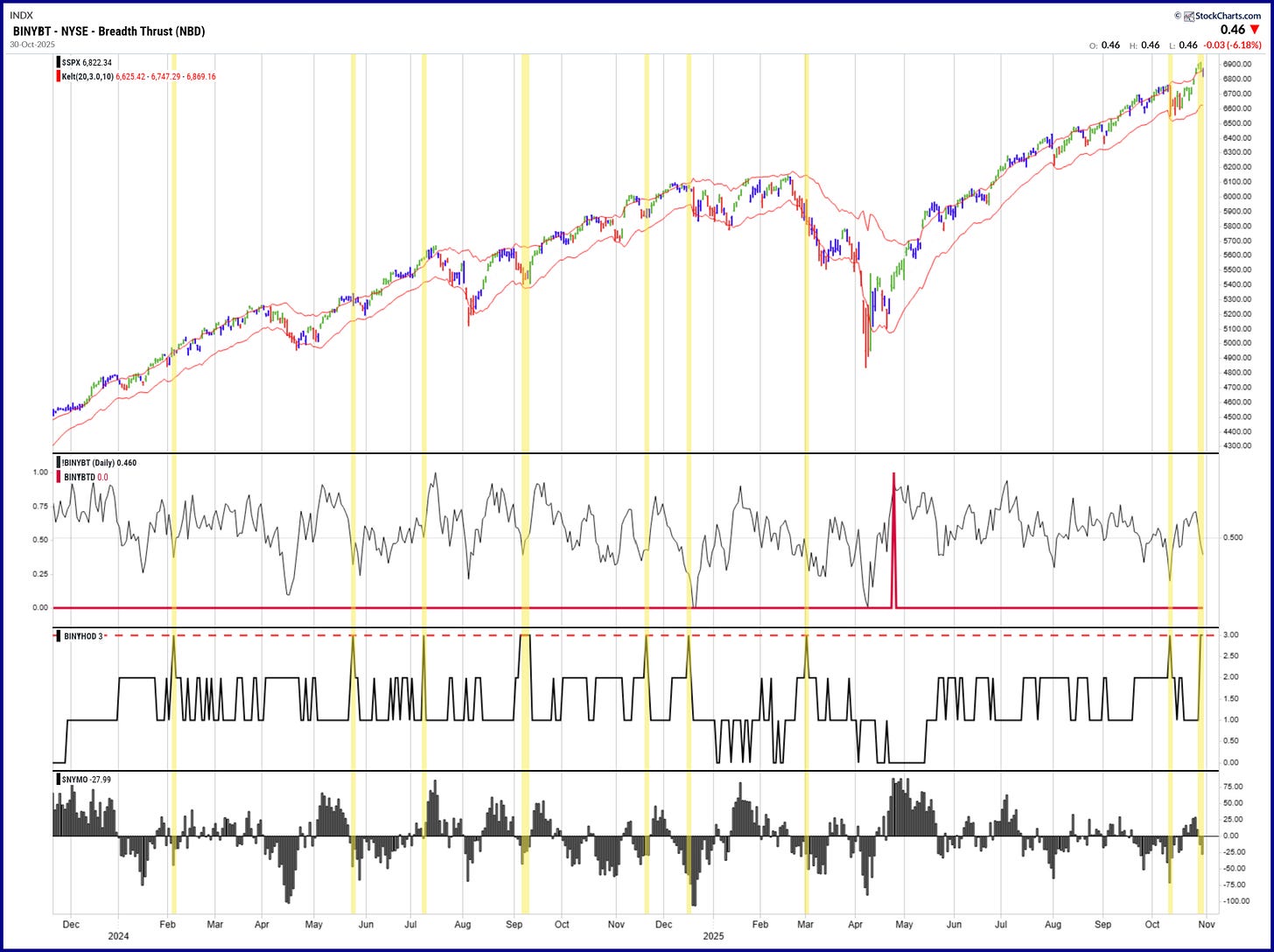

Meanwhile, the talk of “canaries in the coal mine” hit the socials based on recent sightings of the so-called Hindenburg Omen (click the link for an explainer from StockCharts.com). We closed the month with two in a row after an initial signal from the 10/10 mini-tantrum. Before you come at me, I recognize the very mixed record of the Hindy. I take notice because it reflects a potentially fragile condition. I do not see it as a reason sell stocks or short the market.

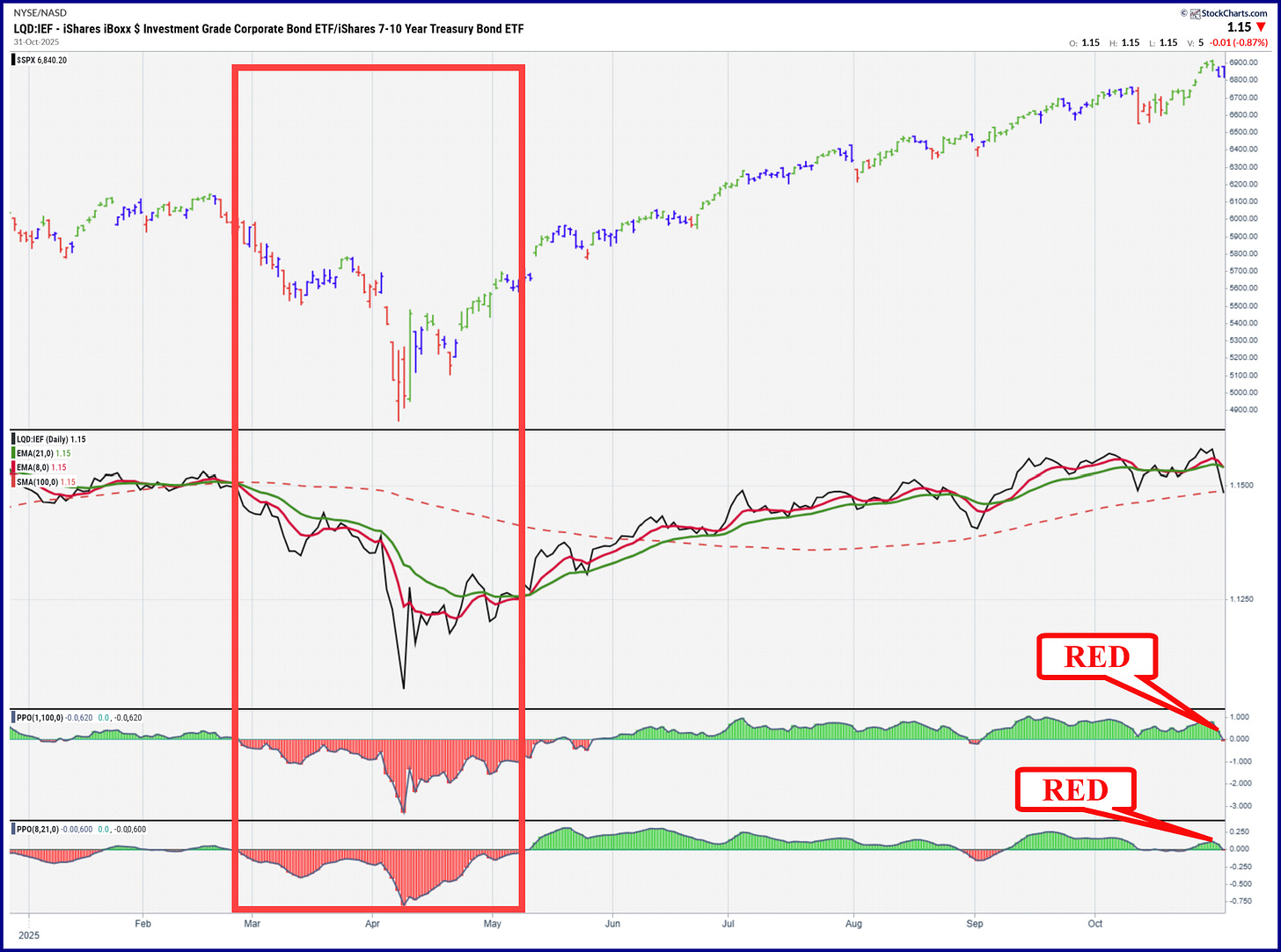

Another canary that hasn’t made the headlines is part of a “regime-shift” model that I monitor. It compares investment-grade bonds (using LQD) to medium-term Treasuries (using IEF). This is one of those relationships that helps put equity market behavior in context. The ratio moving higher is consistent with bullish conditions for stocks and vice versa. Once again, the flip to red on Friday doesn’t mean a damn thing unless it stays red. But it’s another change in conditions that we will be watching.

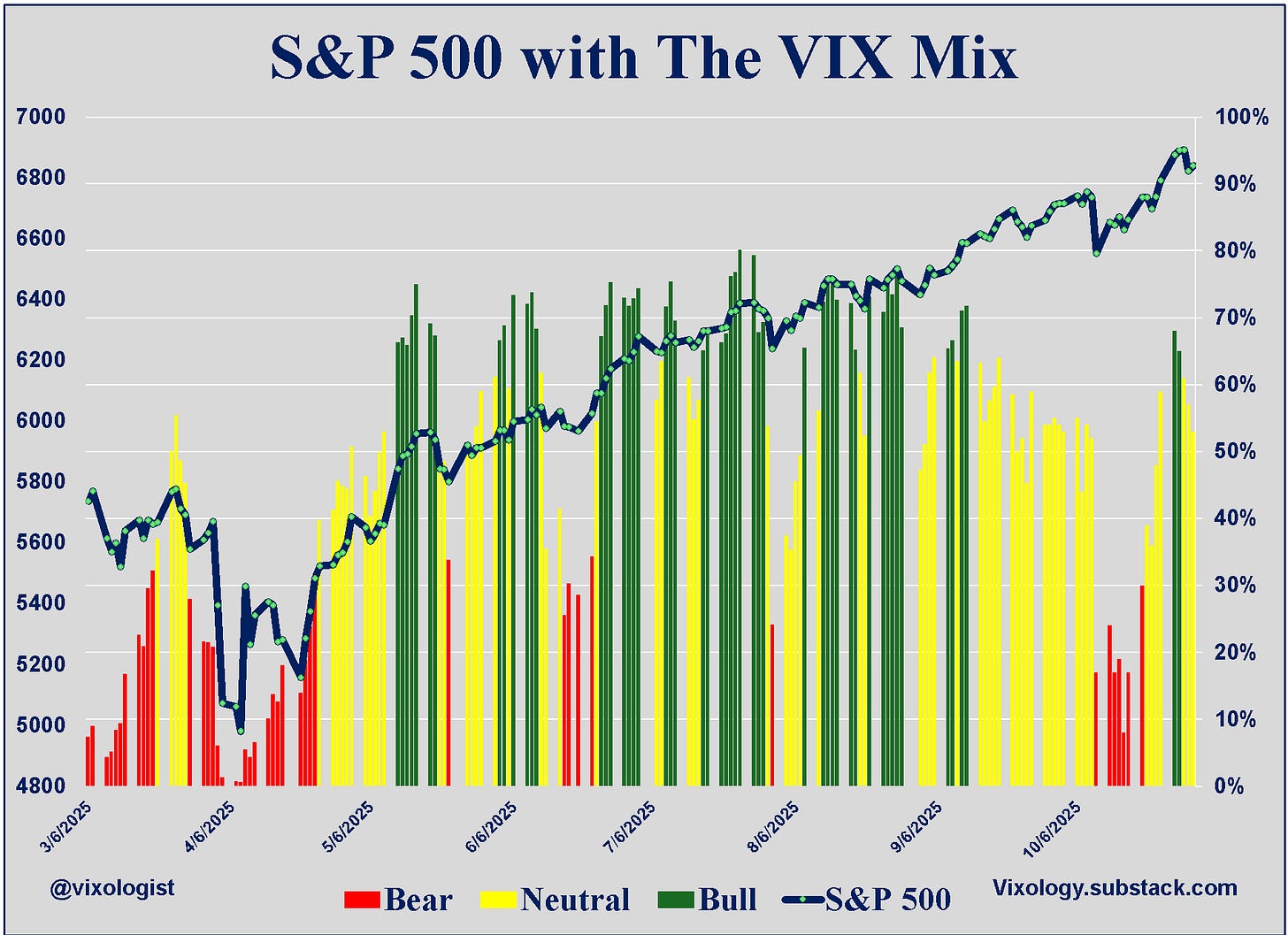

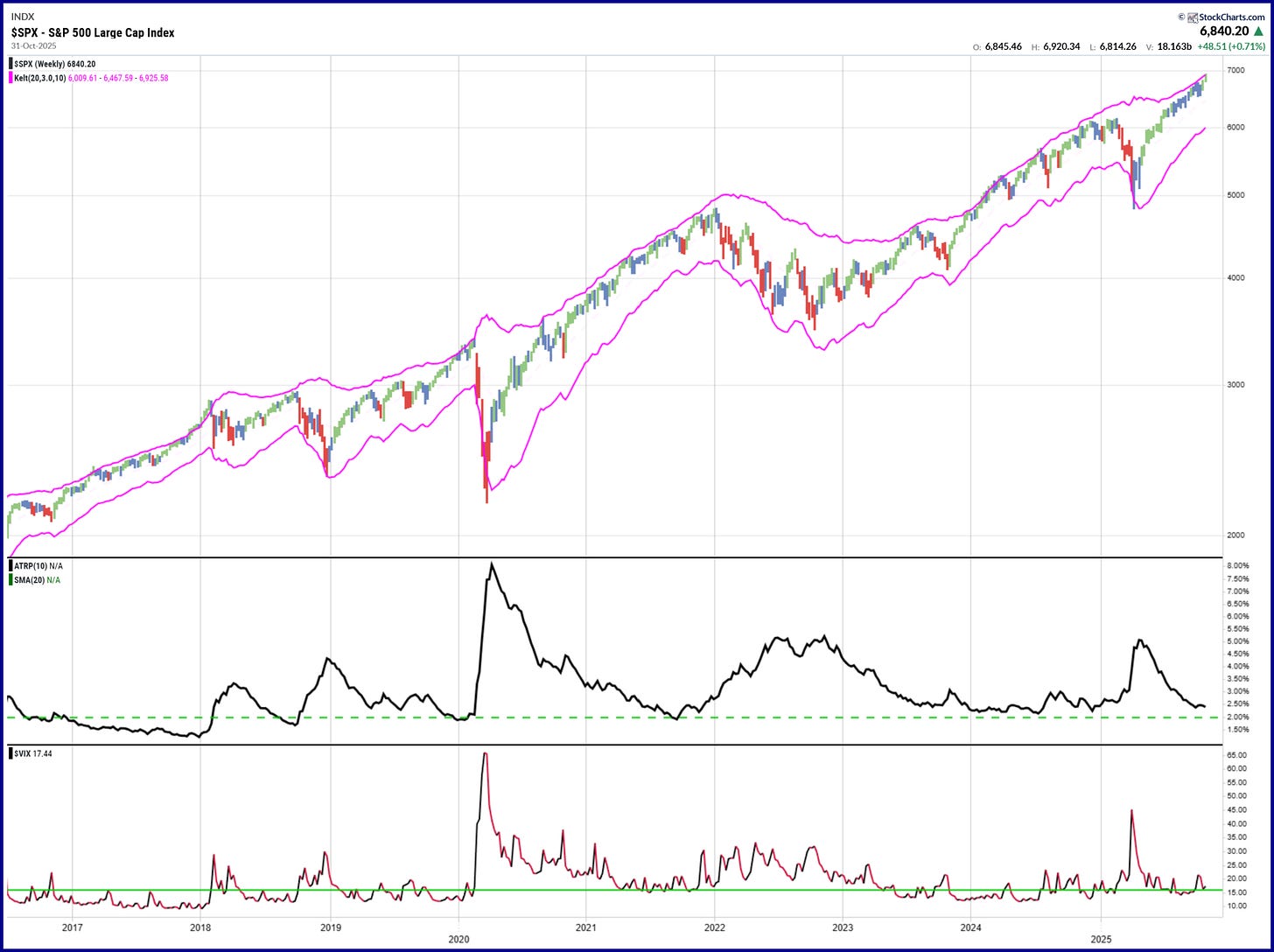

So there may be some canaries flitting around the entrance to our coal mine. But let’s zoom out (as we’ve done recently) to a weekly chart of the S&P 500. We make the following observations:

The uptrend is intact, we are still inside the 3-ATR Keltner Channel and the Elder Impulse is showing no sign of a red bar.

The ATR% has been in a steady decline from the April Tariff Tantrum.

VIX is behaving reasonably well near the 16 level that implies relative calm for the equity market.

Are we approaching an inflection point for stocks? Does the alignment of “bearish” conditions signal a downturn ahead? Long-time readers understand that my response to such questions isn’t very satisfying. “Maybe” is all you’ll get. But my spidey senses are on high alert and a turn for the worse will not come as a surprise because our daily process keeps us tuned in to changes in conditions and when those conditions turn into a call for action.

All content presented here is for informational and educational purposes only. Distribution of any content to any persons other than the recipient is unauthorized. Furthermore, any alteration of content presented here is prohibited. By accepting delivery of this presentation, the reader agrees to the foregoing. Certain information presented herein has been obtained from third-party sources considered to be reliable, but there is no guarantee of completeness or accuracy and it should not be relied upon as such. There is no obligation to update or correct any information presented. Readers should not treat any statement, opinion or viewpoint expressed herein as a solicitation or recommendation to buy or sell any security or follow any investment strategy. This material does not consider the investment objectives, financial situation, or needs of any particular reader. Readers should seek advice from a qualified financial or investment advisor prior to making any investment decision.

I'm still sitting on cash to deploy during a meaningful 10-20% pullback. see how that goes...

I may regret but Ive closed my SVix shorts, monday the buy back shenanigans is back and I have seen this movie multiple times before, so…