Back In Action

And apparently baiting the bears (LOL)

My jury duty is complete. The judged thanked us for prompting several perps to plead out rather than face a jury of their peers. Trust me. You do not want to be judged by a jury of your peers. That is all.

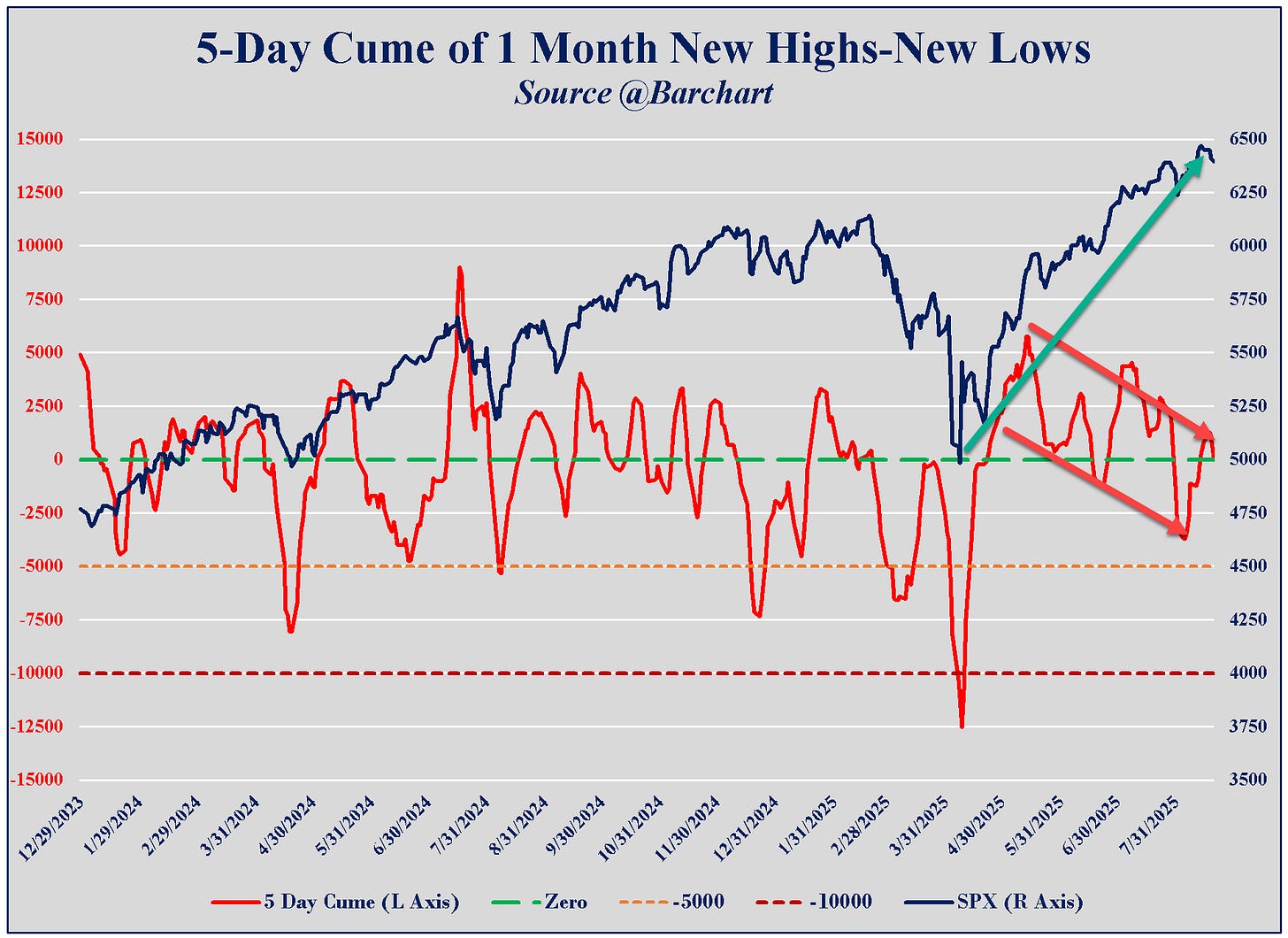

Back in the world of volatility, I had to chuckle this morning when I posted this chart on Twitter and was accused of “doomish bear bait.” Yup, that’s me!! Anyway, one of my favorite ways to look at market breadth is to track new highs and new lows using Barchart data for monthly NHNL and then smoothing it with a 5-day cumulative total. What’s clear from the numbers is that new highs for SPX have been met with a series of lower highs and lower lows for NHNL. This does not mean that SPX will crash. It simply means that the net new highs are diverging from those new highs for the index. The NHNL line might reverse and move higher in support of SPX continuing on its current path. Or SPX could rest for a while and let NHNL recover. I don’t know what will happen. BUT, I will not be surprised if the stock market gives back some portion of its recent gains. That is all.

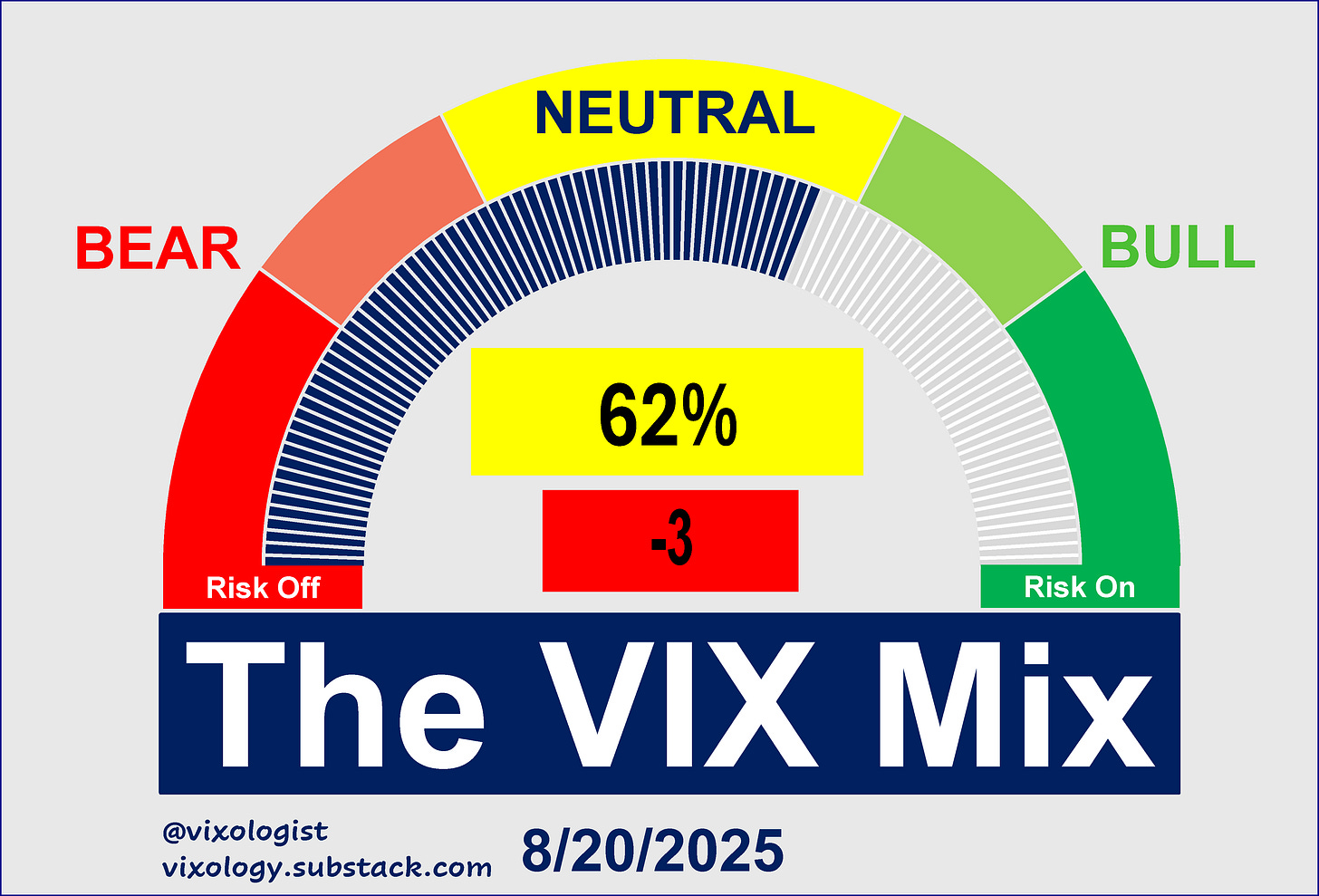

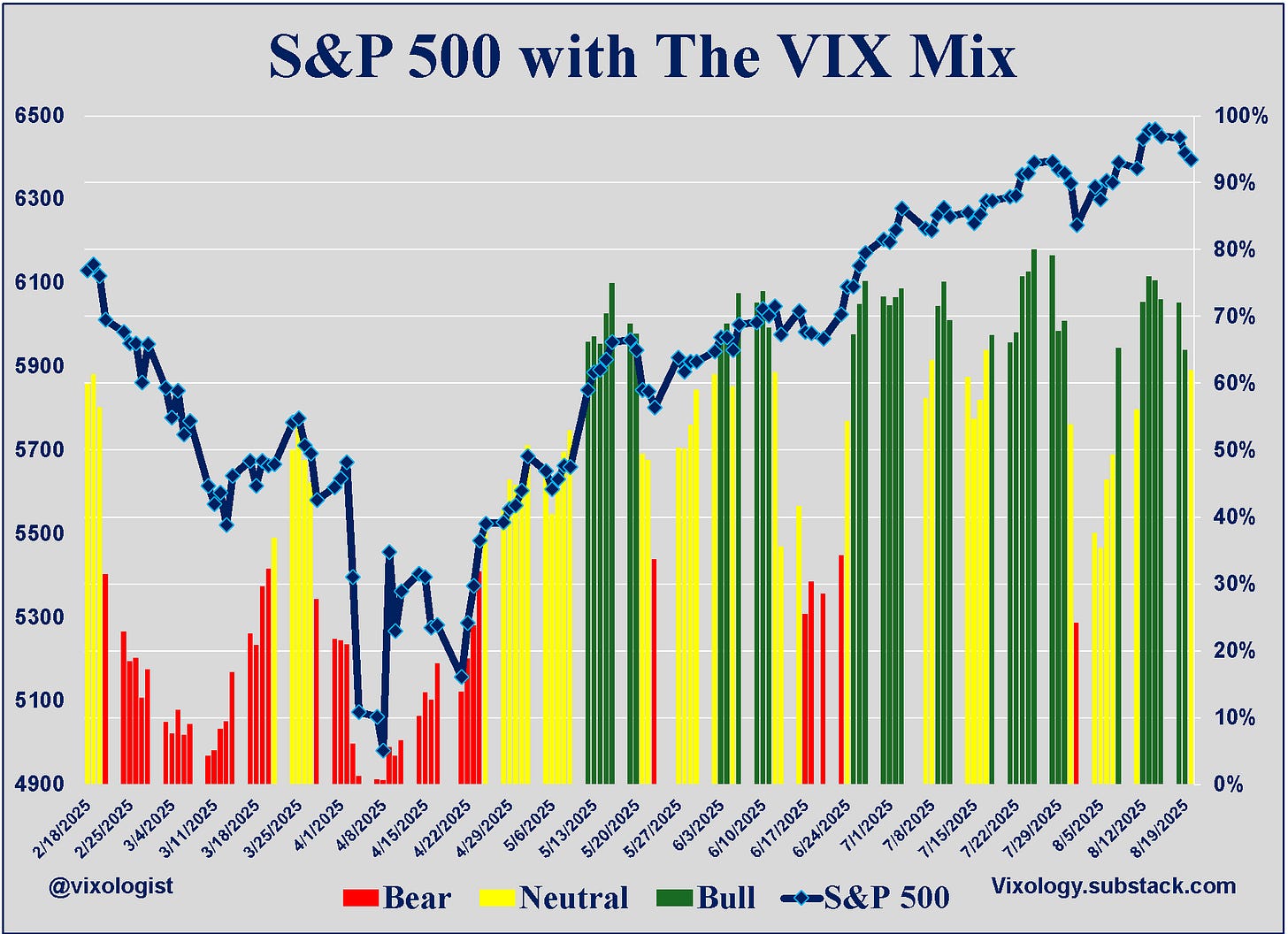

Meanwhile, the VIX Mix weakened again yesterday, breaking its 6-day streak of green. The number of bullish components topped out last Thursday at 14 of 17 and dropped to 9 yesterday after logging 13 bullish on Monday. On the other side of the ledger, only three components are bearish.

I’ll be digging around a little deeper later today and will share any interesting nuggets that come to the surface.

All content presented here is for informational and educational purposes only. Distribution of any content to any persons other than the recipient is unauthorized. Furthermore, any alteration of content presented here is prohibited. By accepting delivery of this presentation, the reader agrees to the foregoing. Certain information presented herein has been obtained from third-party sources considered to be reliable, but there is no guarantee of completeness or accuracy and it should not be relied upon as such. There is no obligation to update or correct any information presented. Readers should not treat any statement, opinion or viewpoint expressed herein as a solicitation or recommendation to buy or sell any security or follow any investment strategy. This material does not consider the investment objectives, financial situation, or needs of any particular reader. Readers should seek advice from a qualified financial or investment advisor prior to making any investment decision.

This looks just like the other 10 dips in SPX over the last few months. Just 2 steps forward and 1.75 back. it's all good!