Another DotCom Moment?

Keep an eye on the weekly charts

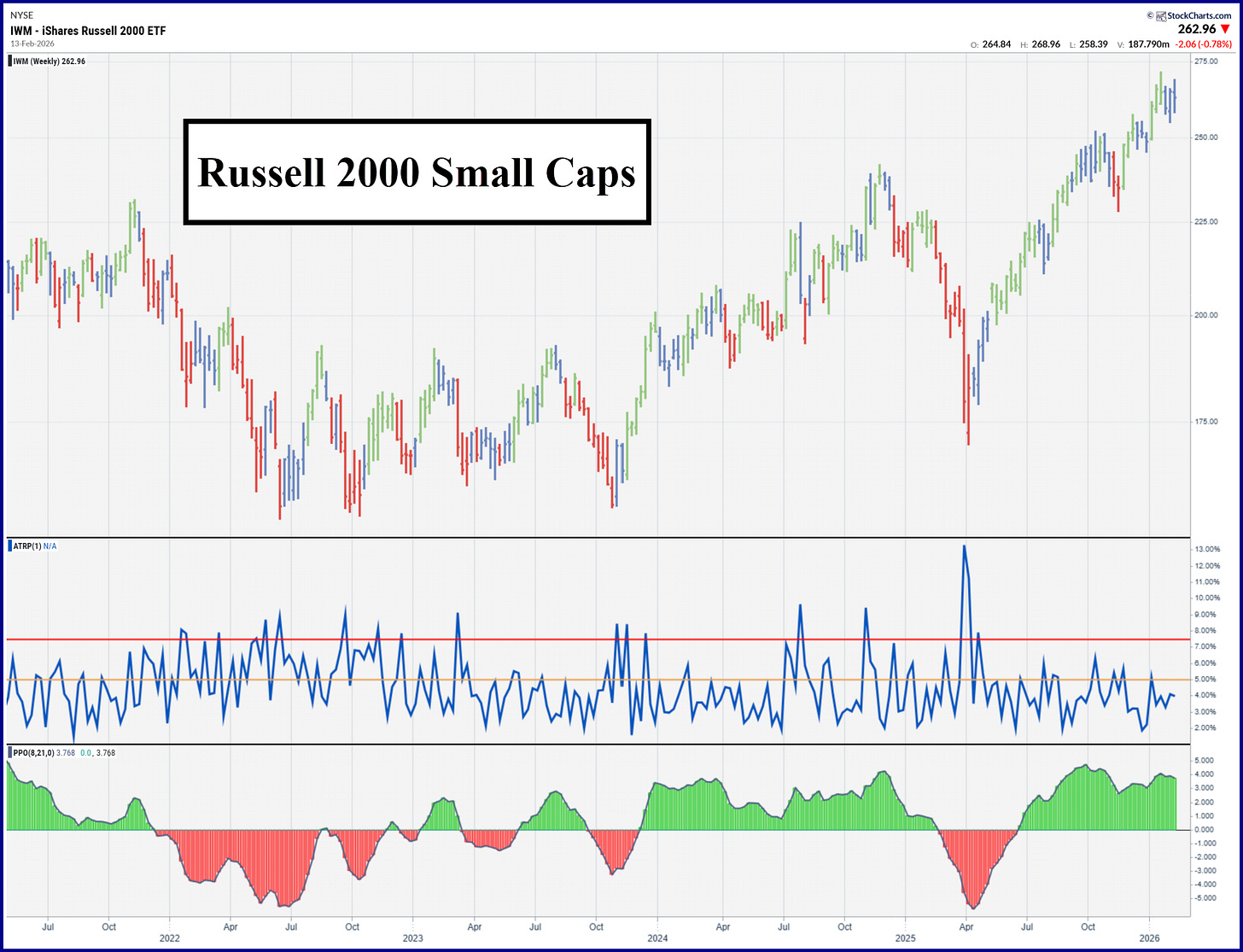

Markets were a bit of a mess this past week as investors wrestled with the possibility that AI will gut industries as diverse as wealth management and transportation logistics. In an eerie callback to the dotcom days, a former karaoke company with a $6 million market cap announced an AI tool for logistics operations and knocked more than 6% off the Russell Trucking Index, with CH Robinson and Landstar both down more than 15% in one day. Yes, really!

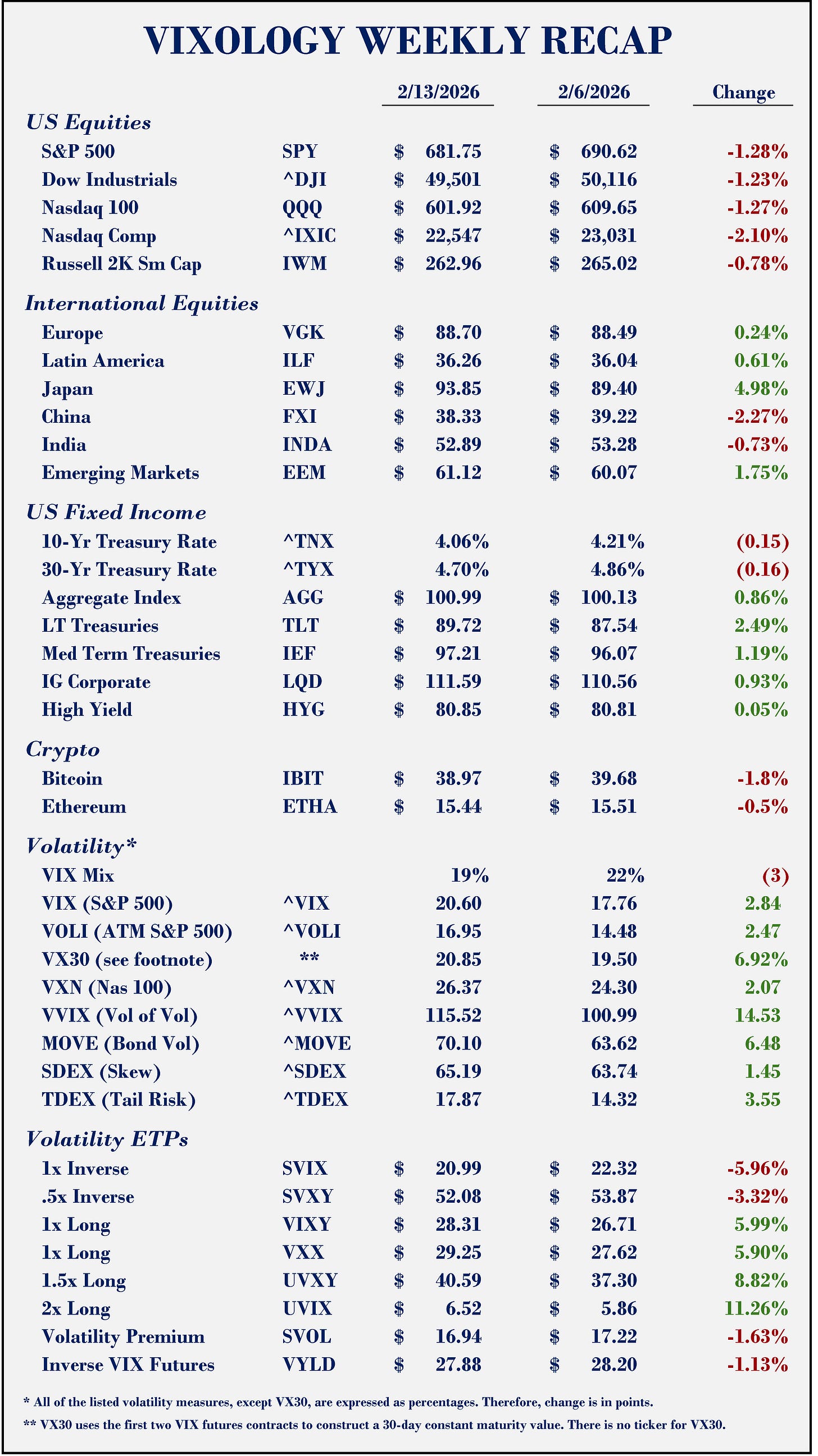

Major US indices all finished the week in the red while the bond market caught a bid and volatility moved higher.

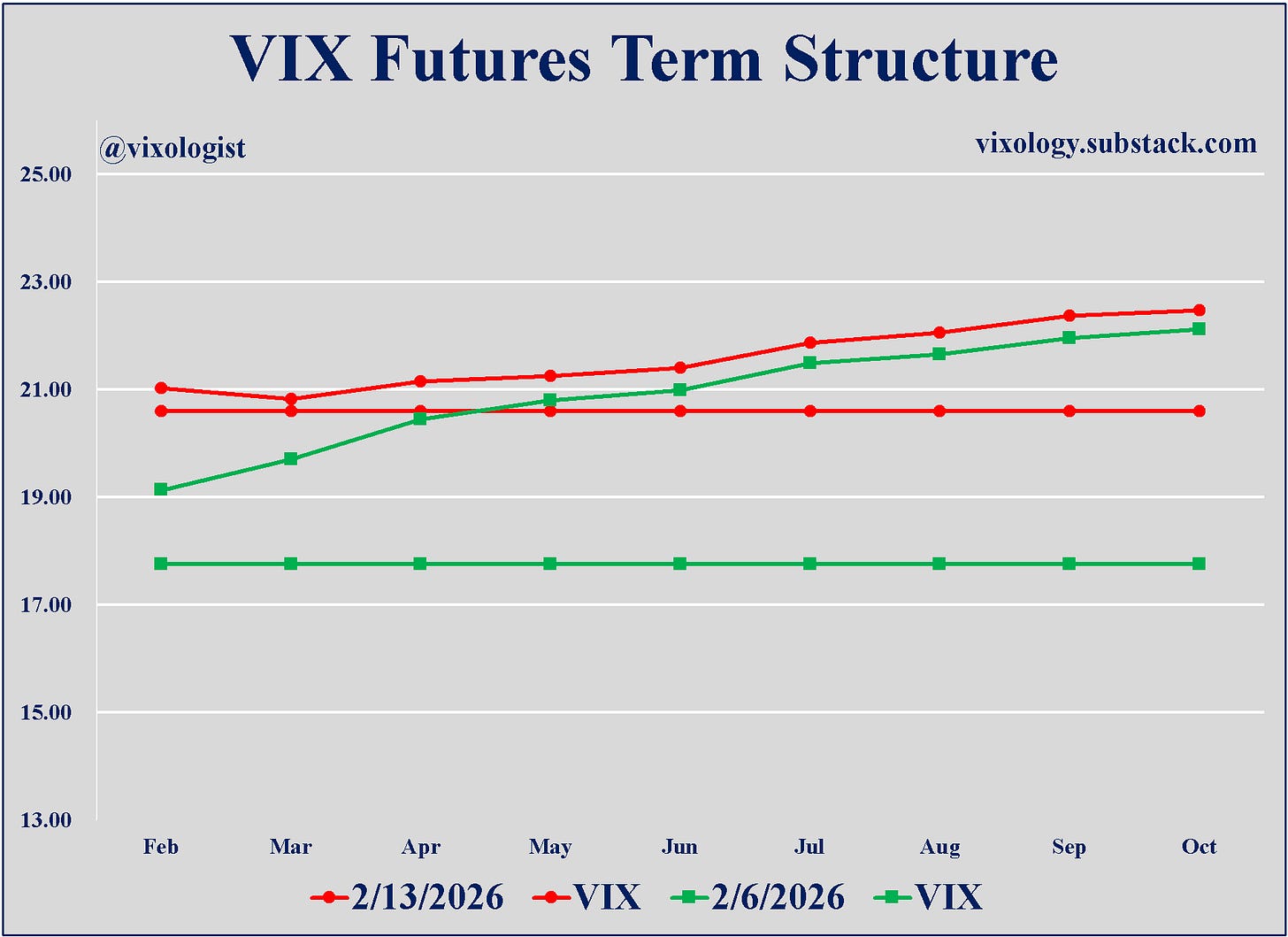

If there’s one chart to sum up the mood in the volatility complex, it would be the week over week change in the VIX futures term structure. Spot VIX rose almost three points with the effect of flattening the futures and producing nice returns for the long volatility exchange-traded products like VXX, VIXY and UVIX.

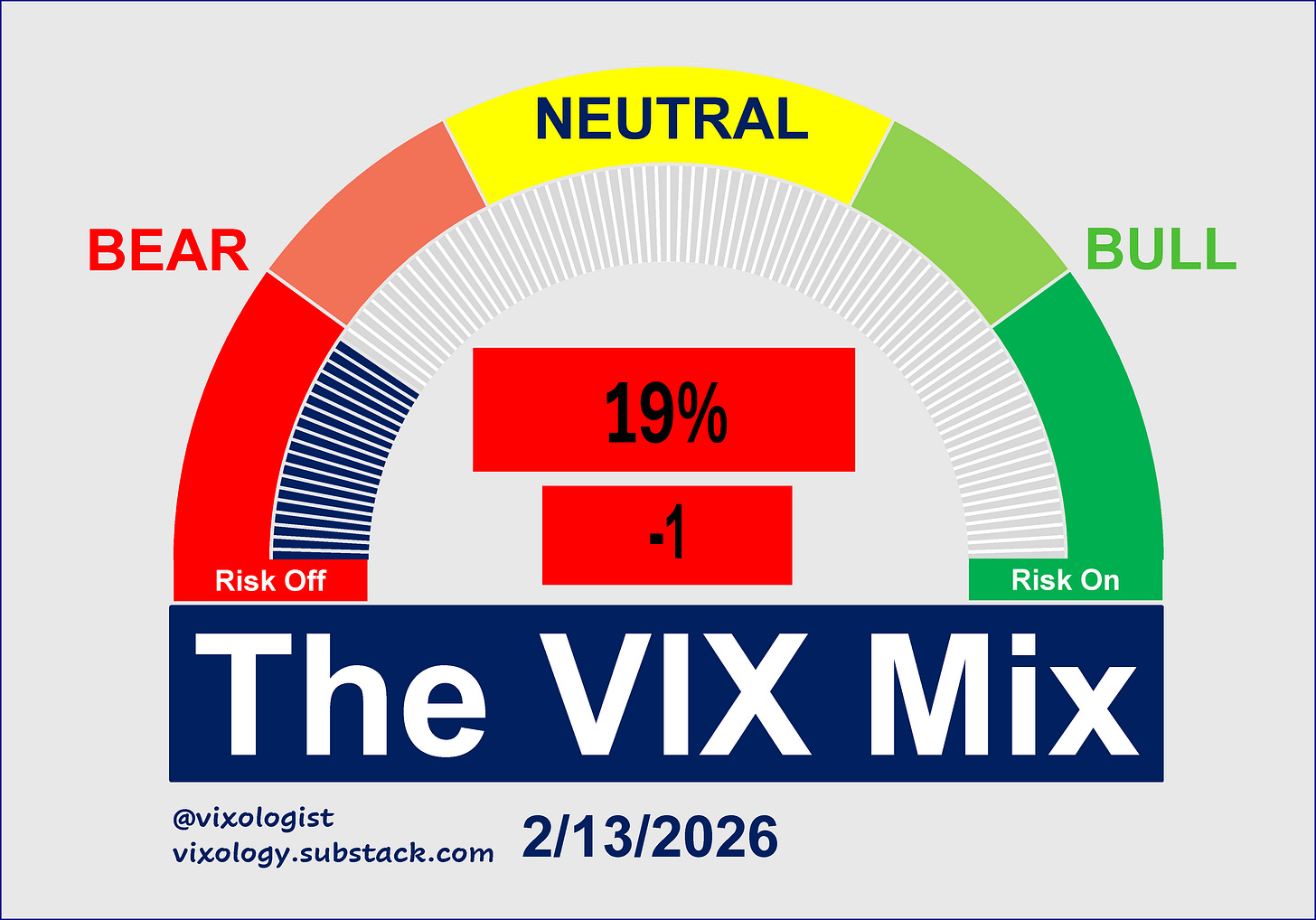

And while the VIX Mix was already bearish coming into the week, it finished even more so with a drop from 22% to 19%. There was also a bearish tilt among the 17 components and Friday’s count was zero green versus 15 in the red.

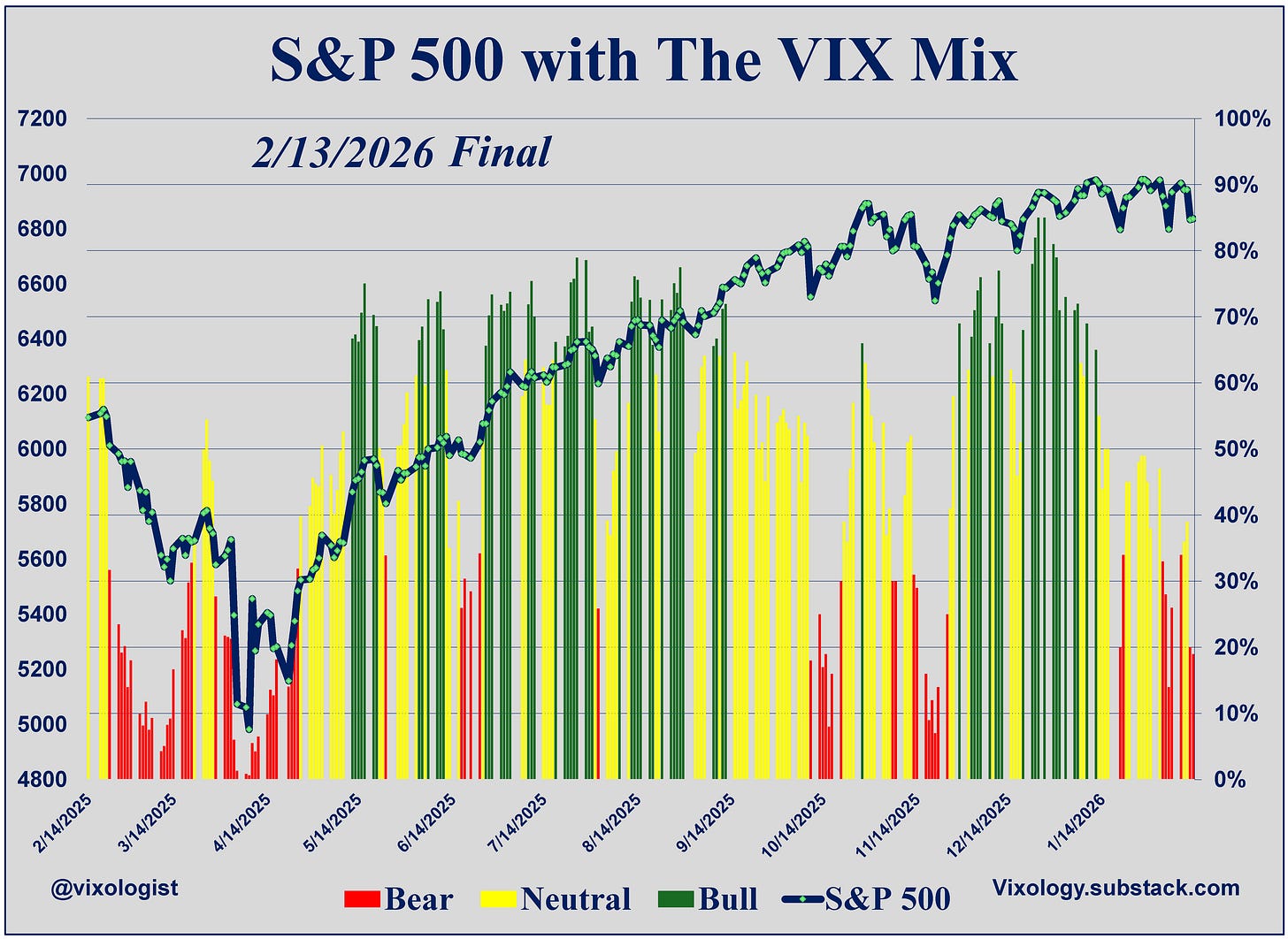

Even as the Dow and S&P500 have put in new all-time highs in 2026, the Mix has been trending lower and it’s been a month (23 trading days) since the chart below has shown a green bar.

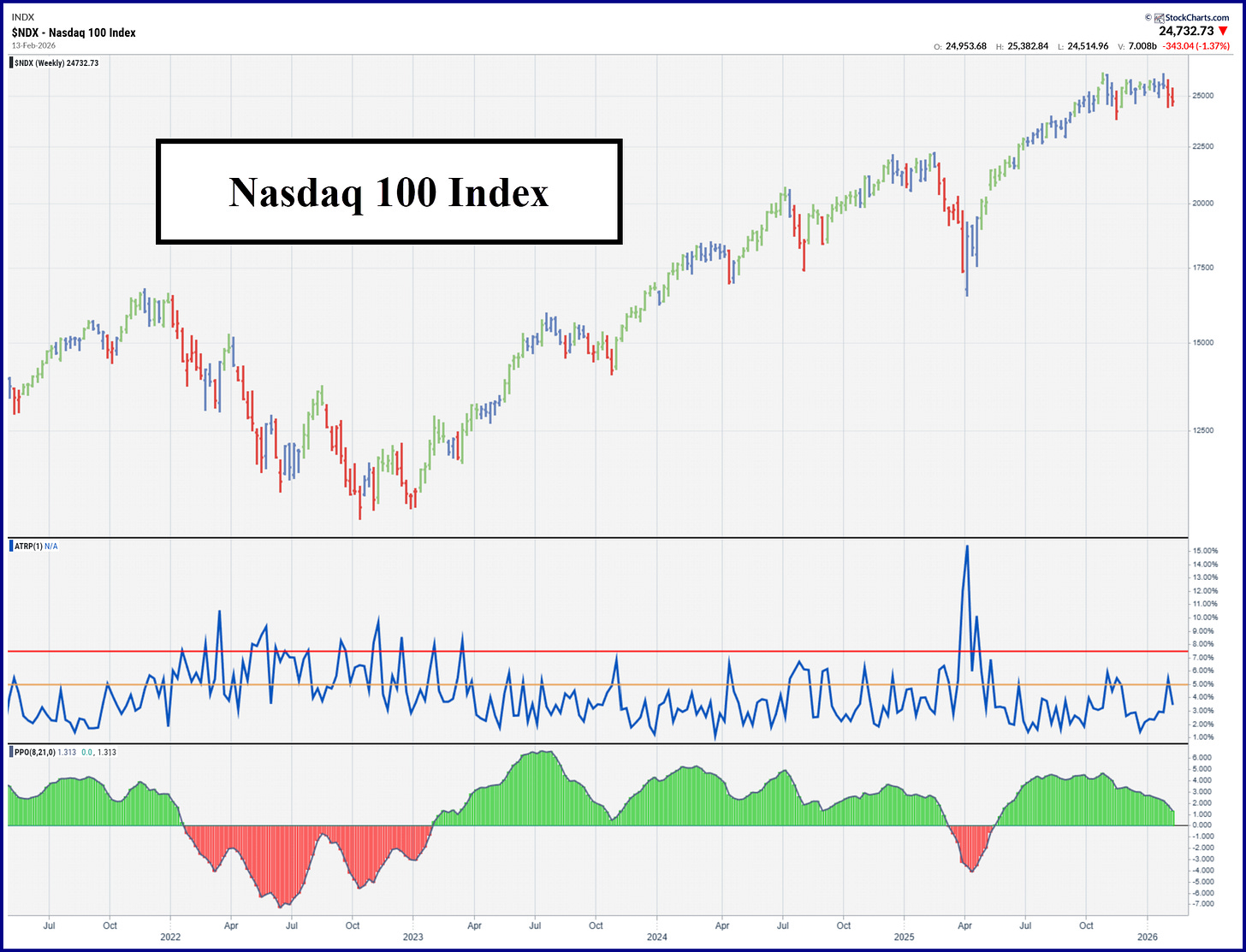

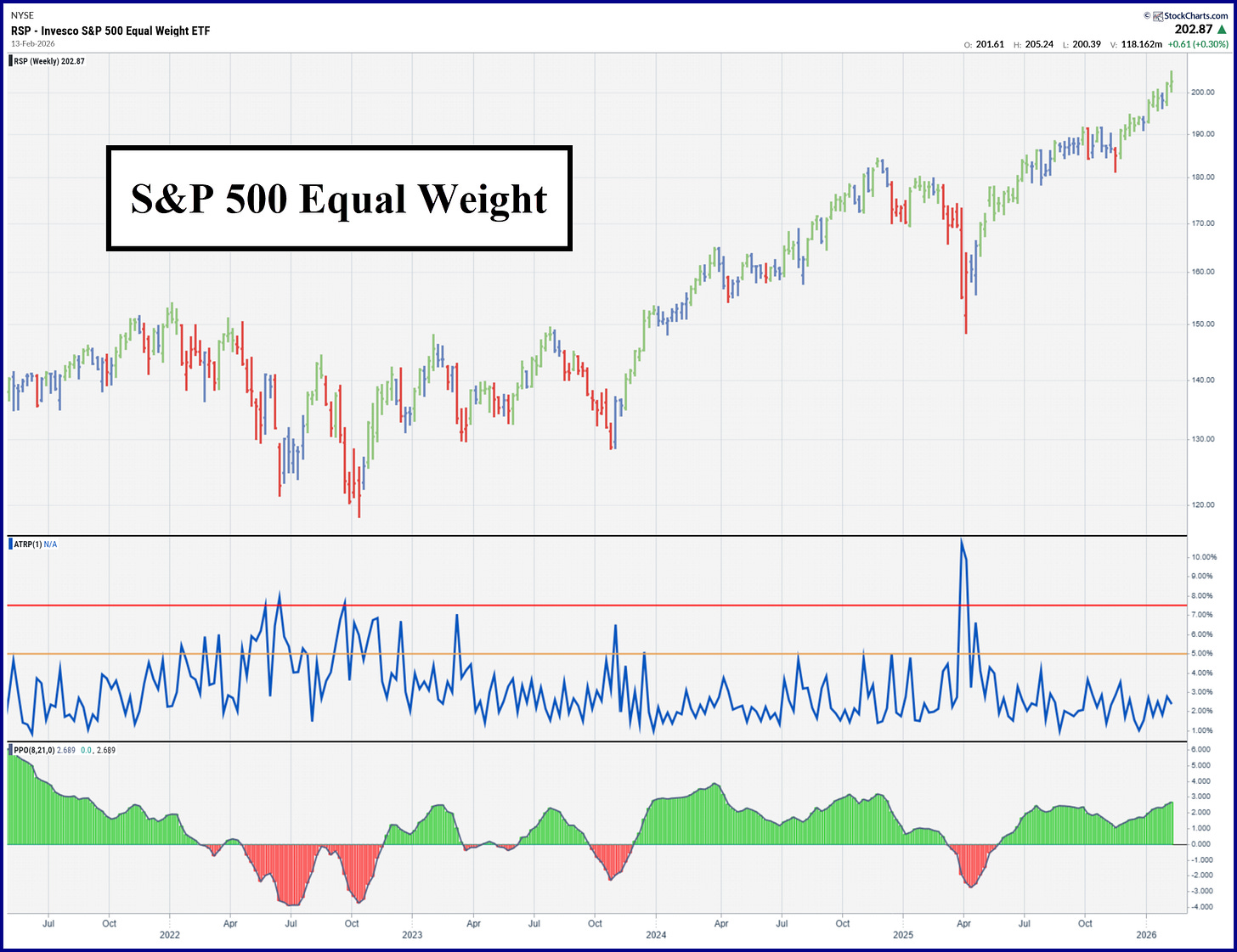

This divergence is telling us that investors have not been “all-in” on the move higher for equities. Even so, zooming out to a weekly view, the US equity markets display uptrends that remain intact. Only one red bar on the far right for the S&P 500, and two for the Nasdaq 100. Both of those indices are dominated by large cap technology companies. On the other hand, the Russell 2000 small caps look very healthy and the equal weight S&P 500 (RSP) is the best of them all with new highs registered each of the past two weeks.

Seems to me that we have a whole bunch of investors who have a nervous outlook and have taken steps to protect the gains in their portfolios. The big-boy indices (SPX and NDX) have seen some air come out of their biggest constituents (Mag 7). Growth has given some back to value and large cap has given some back to small cap. This may be a healthy rotation but not everyone is comfortable. Put the recent volatility of precious metals and crypto into the blend and we have investors looking for the next durable trend while unsure what it will be. We can’t be surprised by more volatility as this plays out. And that volatility could get spicy should we add a nasty headline or two. Long-term investors should keep an eye on the weekly charts. Traders may have some shorter-term opportunities.

All content presented here is for informational and educational purposes only. Distribution of any content to any persons other than the recipient is unauthorized. Furthermore, any alteration of content presented here is prohibited. By accepting delivery of this presentation, the reader agrees to the foregoing. Certain information presented herein has been obtained from third-party sources considered to be reliable, but there is no guarantee of completeness or accuracy and it should not be relied upon as such. There is no obligation to update or correct any information presented. Readers should not treat any statement, opinion or viewpoint expressed herein as a solicitation or recommendation to buy or sell any security or follow any investment strategy. This material does not consider the investment objectives, financial situation, or needs of any particular reader. Readers should seek advice from a qualified financial or investment advisor prior to making any investment decision.