Another Brick (Or Two)

Climbing the wall of worry

All eyes and ears are focused on this morning’s Jackson Hole speech - likely the last major presentation of his stint as Fed Chairman. Not to be outdone, the White House has alerted the world that the President will have a major announcement at noon. The tension is palpable. But to paraphrase “Pink” - All in all, they’re just two more bricks in the wall. Pink Floyd

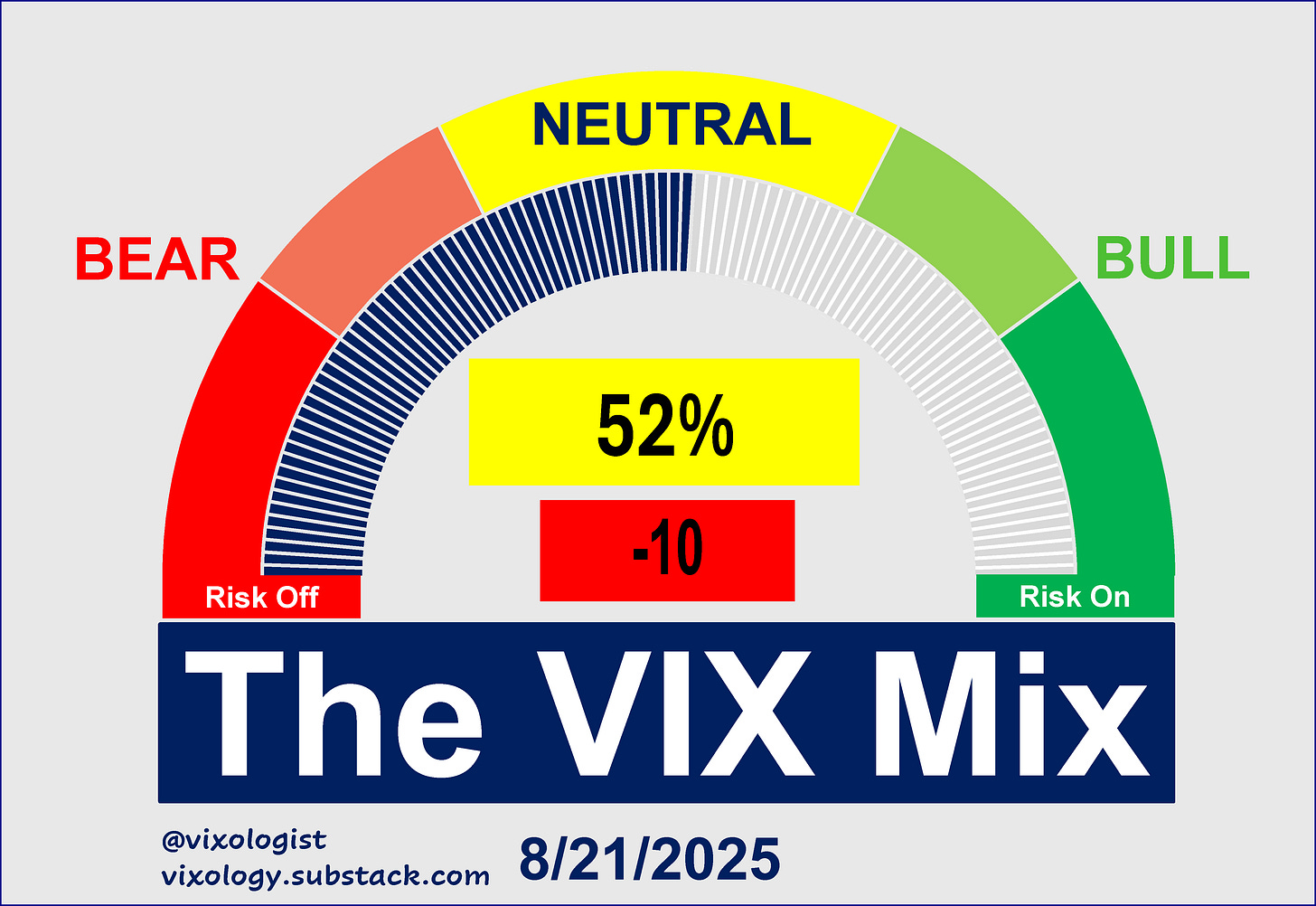

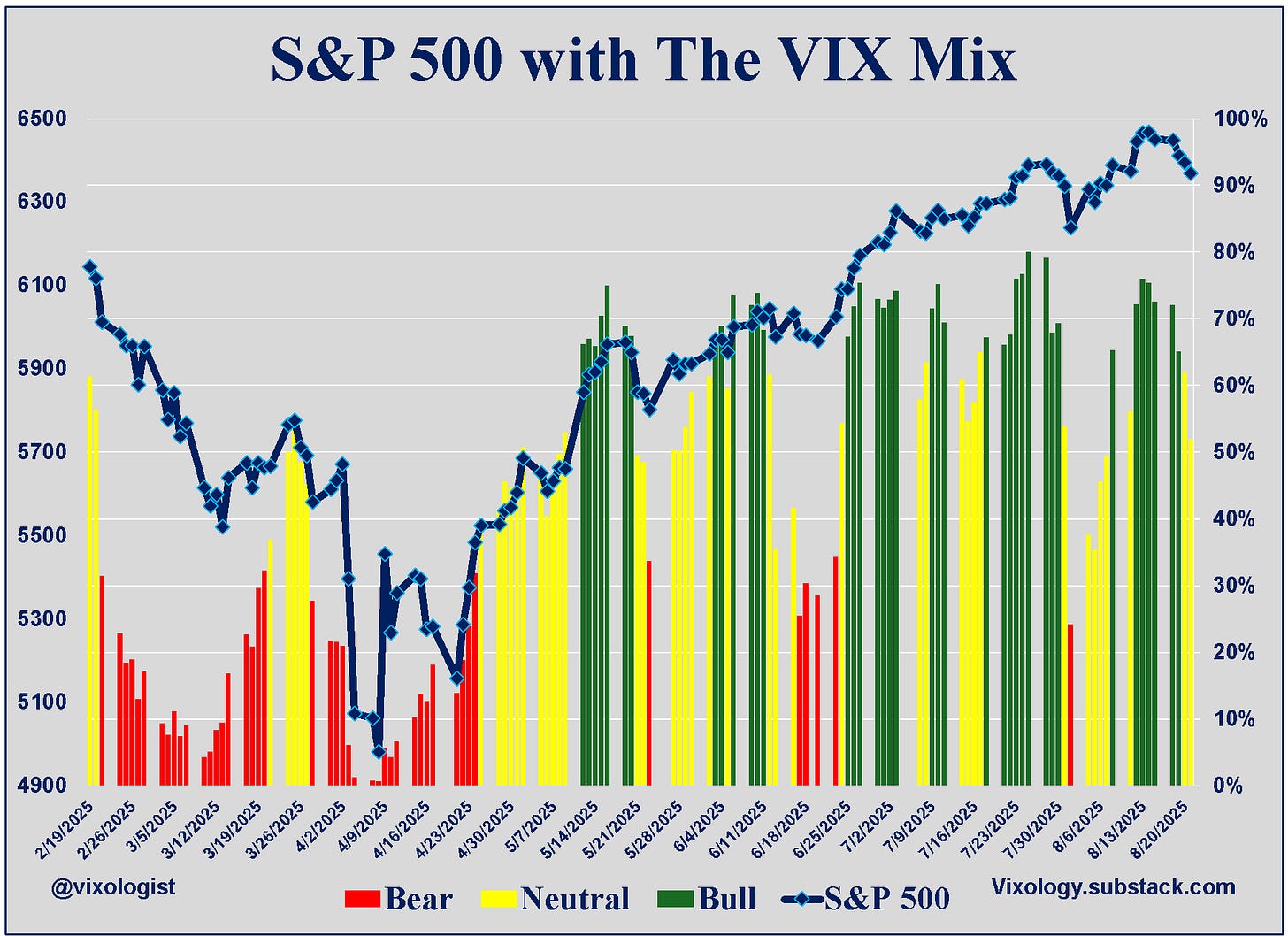

We can’t be surprised that markets are showing signs of apprehension. Our volatility composite, The VIX Mix, retreated further into neutral territory yesterday with only five of 17 components still bullish while four check in on the bearish side. Investors view Powell’s speech as a potential source of turmoil even as the odds of a September rate cut remain high. The mystery White House announcement only adds to concerns.

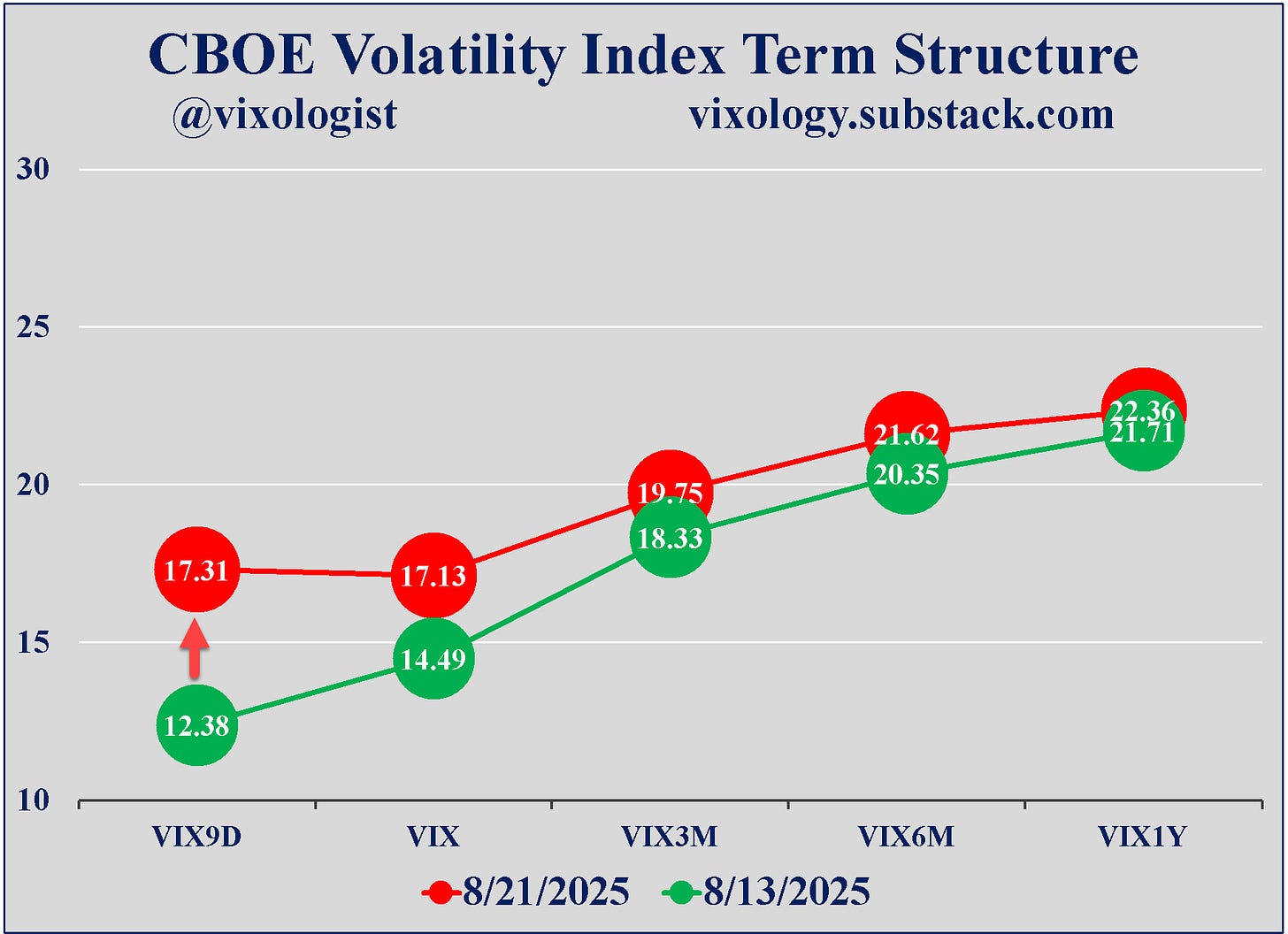

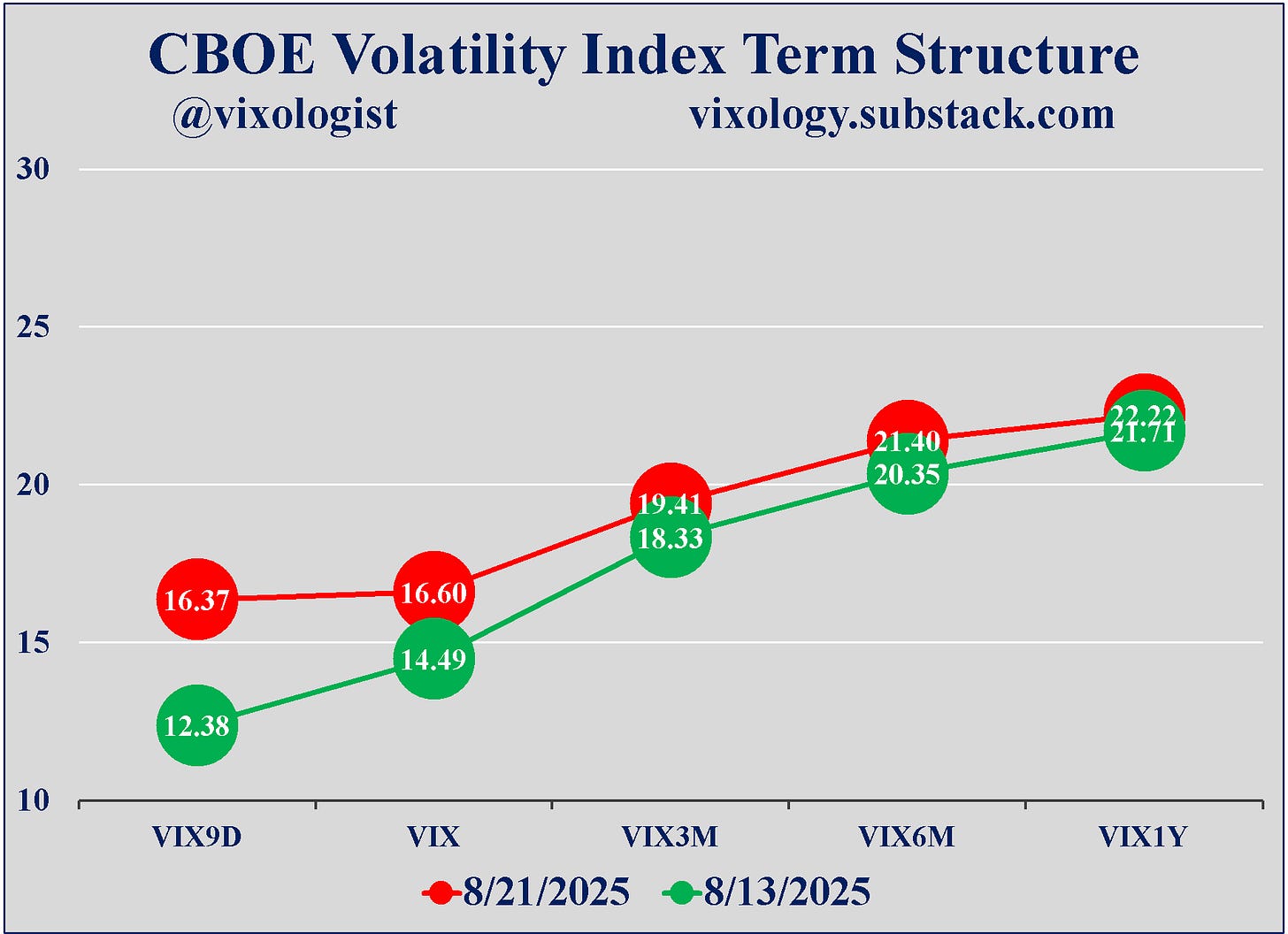

In the middle of yesterday’s regular trading hours, we saw these worries push VIX9D north of VIX as investors focused on short-term risks. The chart below shows this intraday worry and compares that term structure with the recent term structure lows on August 13th.

Things calmed down by the end of the trading day, though VIX9D remained elevated relative to what we would normally expect. Long-term averages for the ratio of VIX9D to VIX would put it around 15.80.

Gauging another measure of volatility term structure that’s part of the VIX Mix, the relationship of mid-term VIX futures (VIXM) to short-term VIX futures (VIXY) has been positive (good for risk assets) since the beginning of May and continues to look good. Do you have this on your checklist the way I do?

By the end of the day, we’ll have two “known unknown” bricks that will either be cemented into the wall or used to smash some glass. I have no predictions but eagerly await the outcomes. We’ll take a look at the impact in our weekend post.

All content presented here is for informational and educational purposes only. Distribution of any content to any persons other than the recipient is unauthorized. Furthermore, any alteration of content presented here is prohibited. By accepting delivery of this presentation, the reader agrees to the foregoing. Certain information presented herein has been obtained from third-party sources considered to be reliable, but there is no guarantee of completeness or accuracy and it should not be relied upon as such. There is no obligation to update or correct any information presented. Readers should not treat any statement, opinion or viewpoint expressed herein as a solicitation or recommendation to buy or sell any security or follow any investment strategy. This material does not consider the investment objectives, financial situation, or needs of any particular reader. Readers should seek advice from a qualified financial or investment advisor prior to making any investment decision.