And We're Off!!

Annual review coming soon

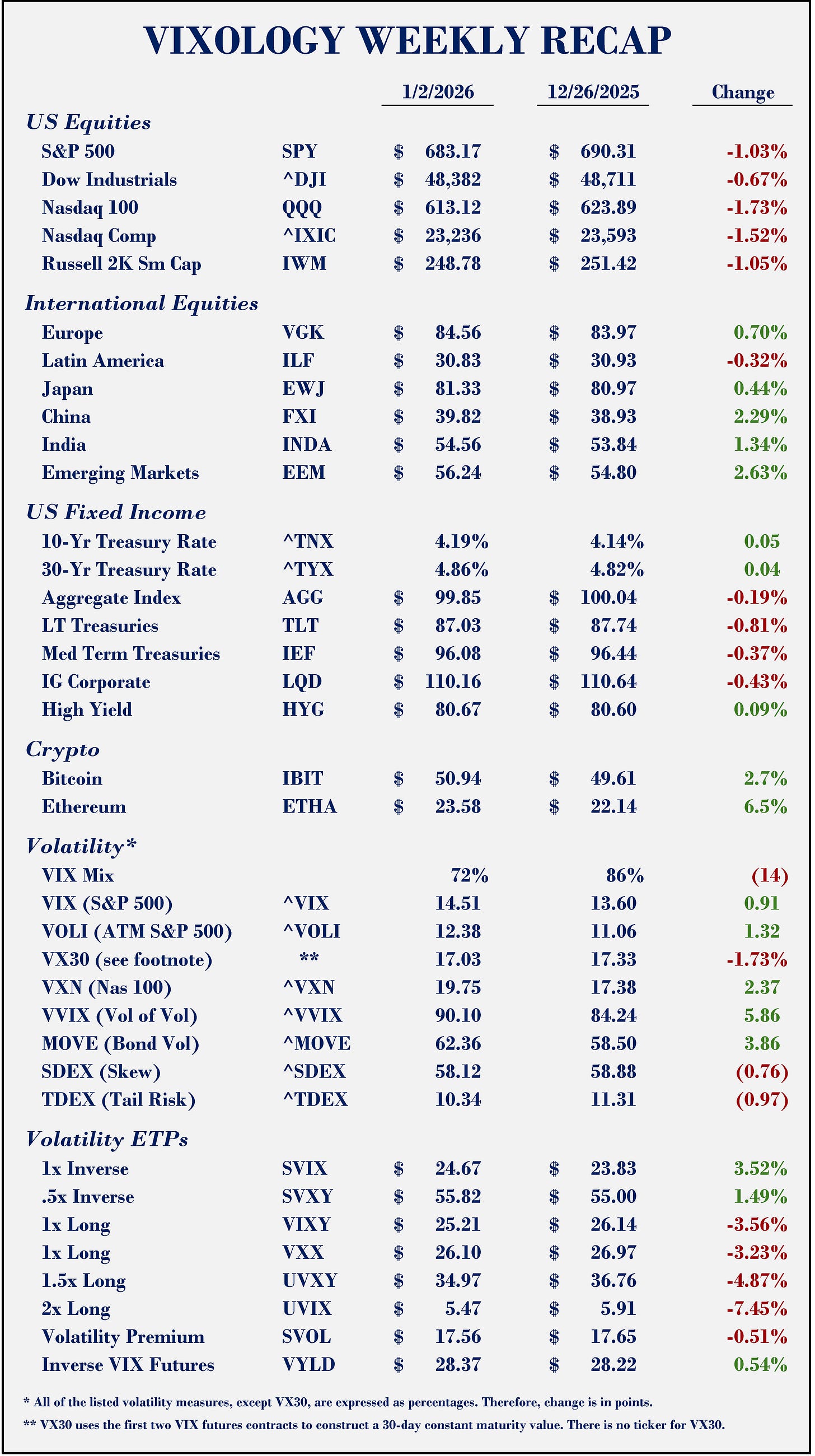

The first trading day of 2026 is in the books with some improvement across equity indices and the volatility complex. It also closed out a holiday-shortened week that saw US equities lower while most international equity indices finished in the green. Fixed income prices ticked lower while major crypto prices improved.

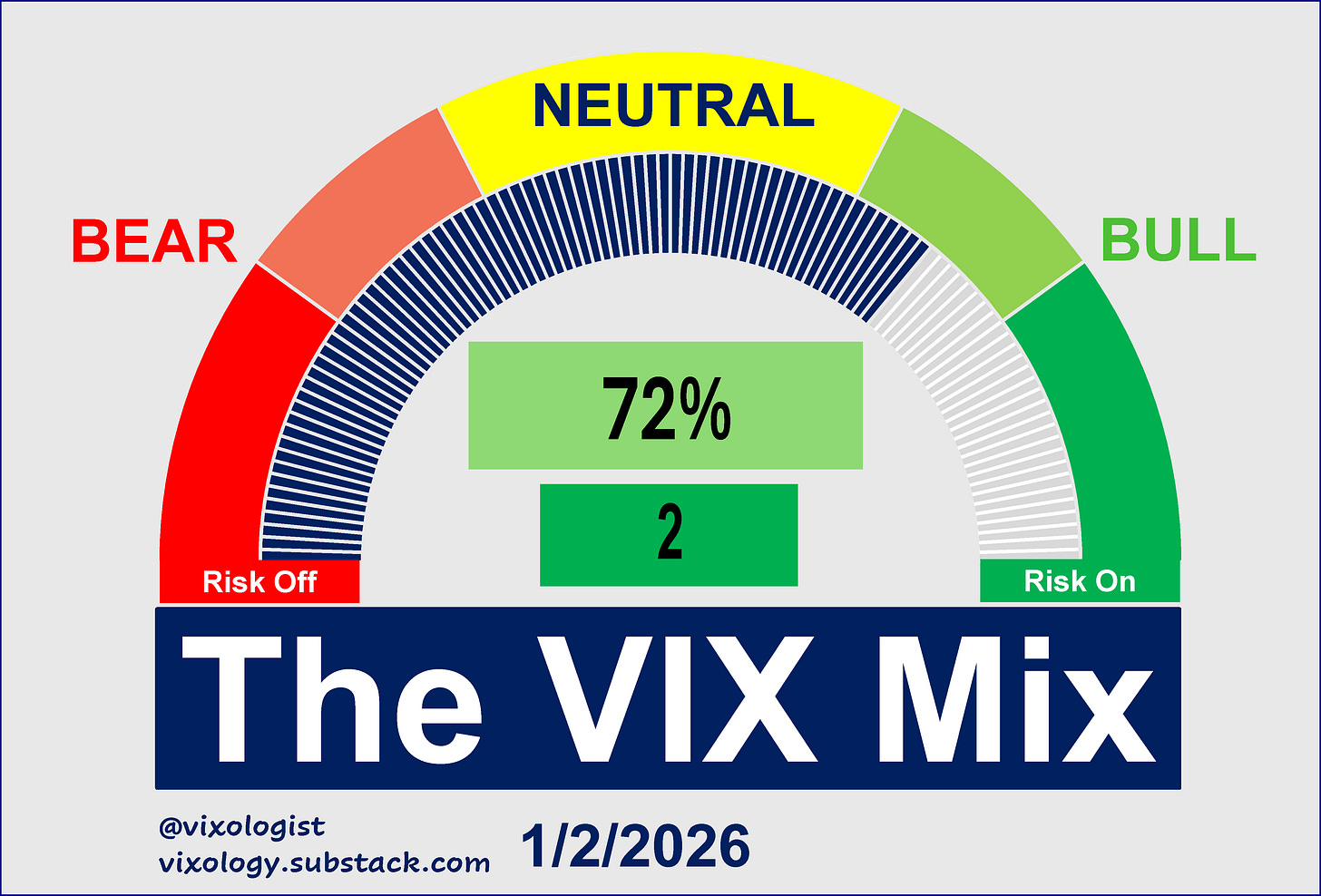

The VIX Mix finished the week on a positive note, adding two points to hold in the green for a ninth day in a row.

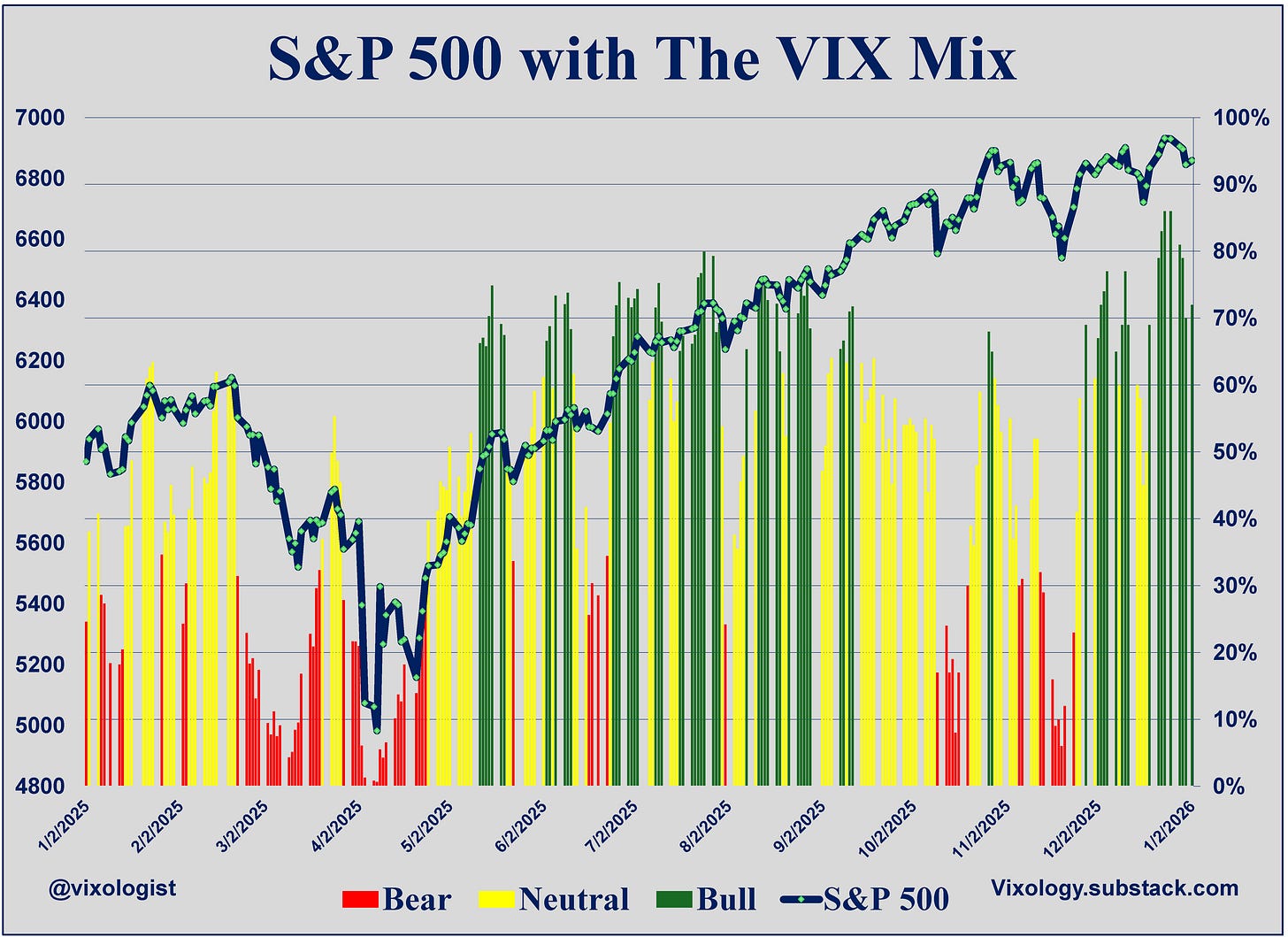

11 of 17 Mix components are bullish with only one sitting in the red. As seen below, the VIX Mix has been mostly bullish since the start of December.

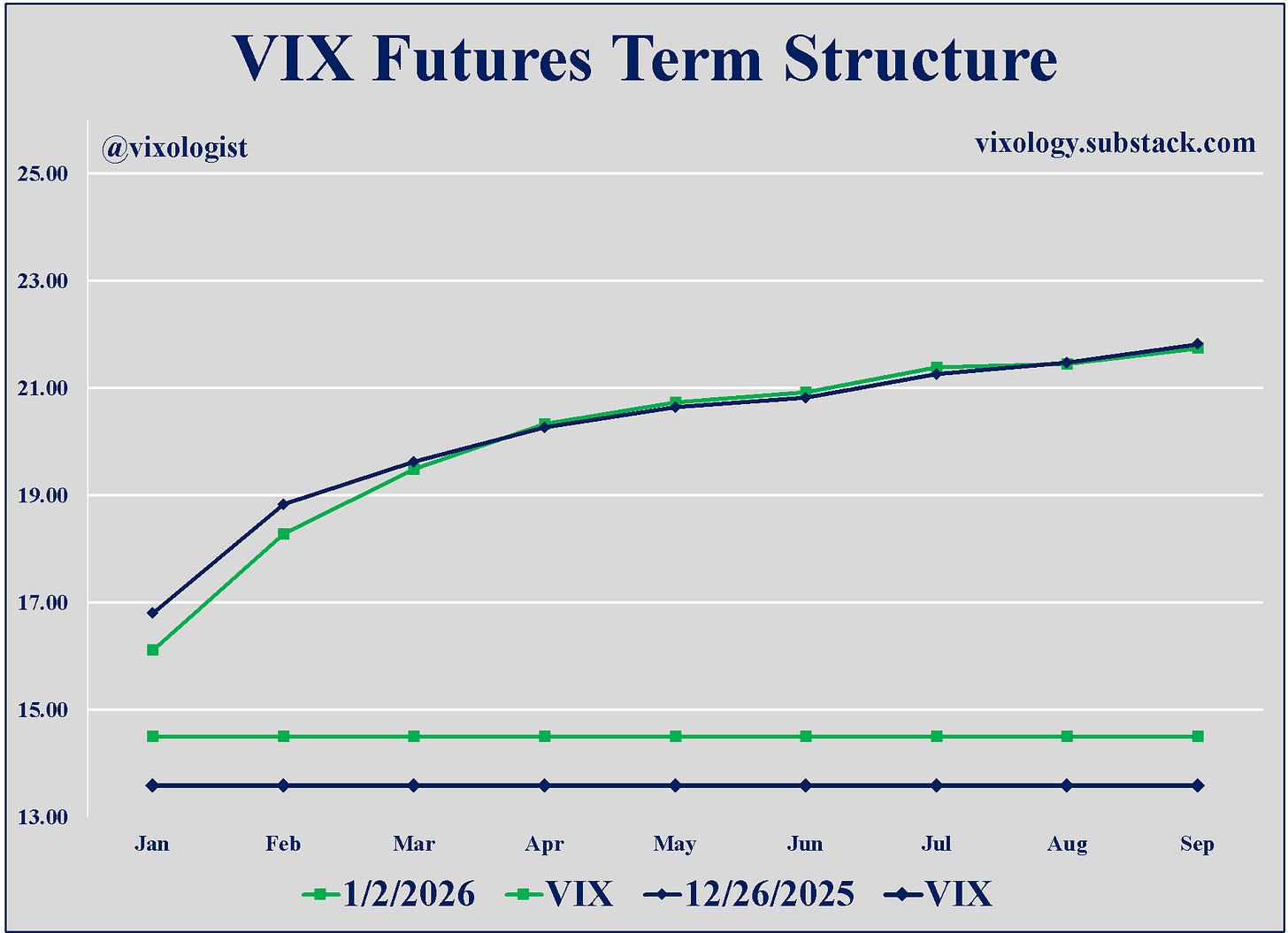

The VIX futures term structure continues to show strong contango that represents a tailwind for the short vol trade. Note on the chart below that the January and February VIX futures contracts dropped week-over-week even as spot VIX closed 90 basis points higher. We can attribute this to relative calm in equity markets combined with the passage of time on the way to expiration of the front month futures on Jan 21st.

Another view of the bullishness reflected in the VIX futures term structure can be seen in this chart of the ratio between mid-term (VIXM) and short-term (VIXY). As we’ve discussed before, a rising ratio reflected in moving average crossovers is a bullish condition that supports risk-on positioning (long equities or short volatility).

We’re hard at work compiling our annual review for 2025 and expect to roll it out early next week. We previewed some of our observations on Volatility Views yesterday. You should be able to find the episode on your podcast platform of choice. But don’t look for predictions. We prefer preparation and anticipation. Hopefully, we can help you with a bit of both in the new year.

All content presented here is for informational and educational purposes only. Distribution of any content to any persons other than the recipient is unauthorized. Furthermore, any alteration of content presented here is prohibited. By accepting delivery of this presentation, the reader agrees to the foregoing. Certain information presented herein has been obtained from third-party sources considered to be reliable, but there is no guarantee of completeness or accuracy and it should not be relied upon as such. There is no obligation to update or correct any information presented. Readers should not treat any statement, opinion or viewpoint expressed herein as a solicitation or recommendation to buy or sell any security or follow any investment strategy. This material does not consider the investment objectives, financial situation, or needs of any particular reader. Readers should seek advice from a qualified financial or investment advisor prior to making any investment decision.