Am I Wrong??

We might be standing at the crossroads

Kevin Moore was born in Los Angeles to parents who grew up in Texas and Louisiana. Blues and gospel influences won out over the Beach Boys as Kevin found his musical compass and picked guitar as his primary instrument. When the drummer in one of his early bands began referring to him as Keb’ Mo’ the moniker stuck and served to launch a career that is still running strong.

“Am I Wrong” showed up on Keb’s eponymous second studio album but my favorite version is this one on Lee Ritenour’s “6 String Theory” album that includes Keb’ and Taj Mahal in one of many collaborations between the two bluesmen.

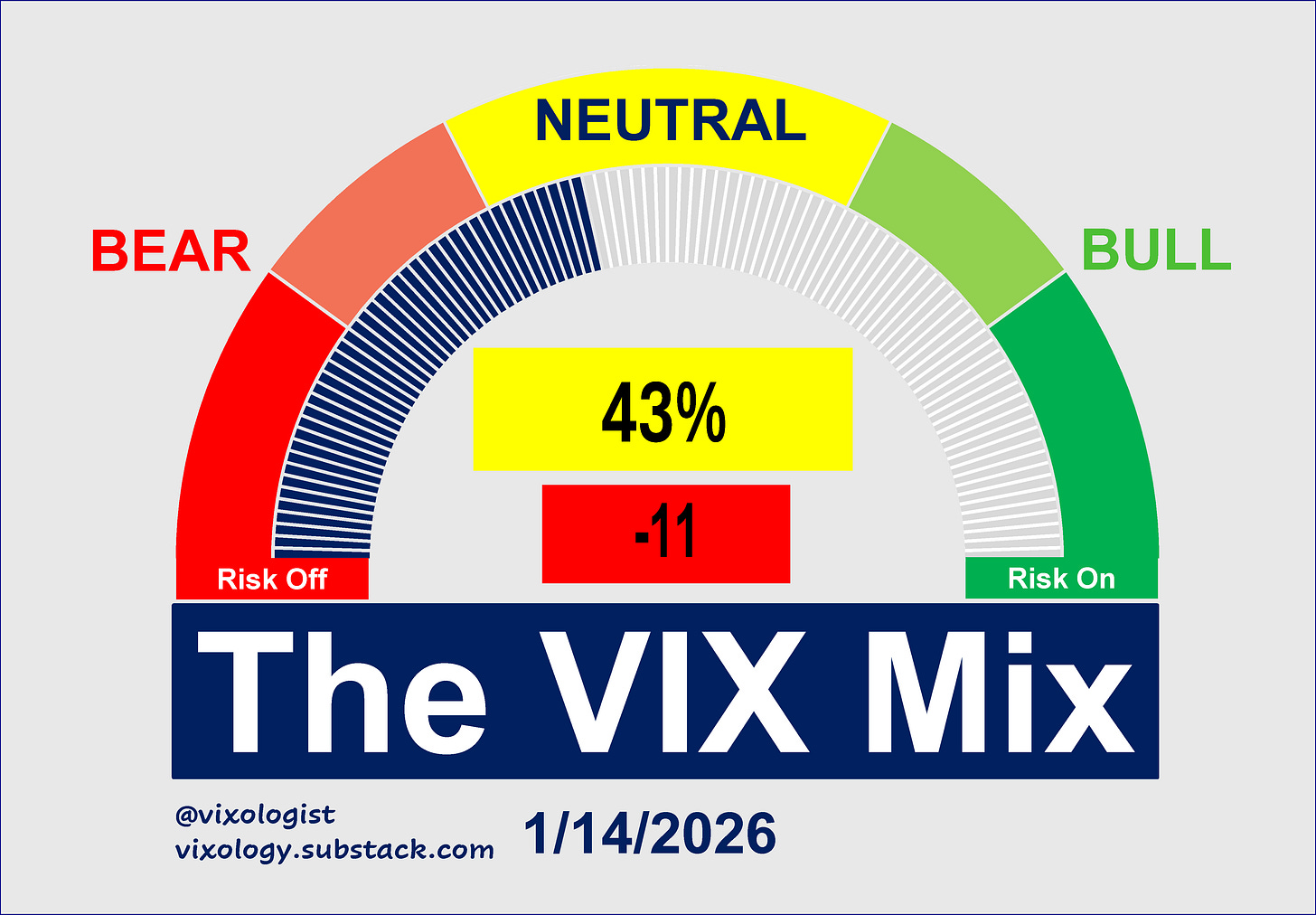

The song came to mind this morning as I observed that the VIX Mix had collapsed another ten points yesterday, equity markets had an intraday fainting spell and, even so, there were several signs that trouble for the headline indices was drawing attention away from underlying strength. Was I wrong to see the weakness in the VIX Mix as cause for concern?

A drop of 11 points yesterday on top of the ten-point giveback on Tuesday seems a reasonable cause for concern.

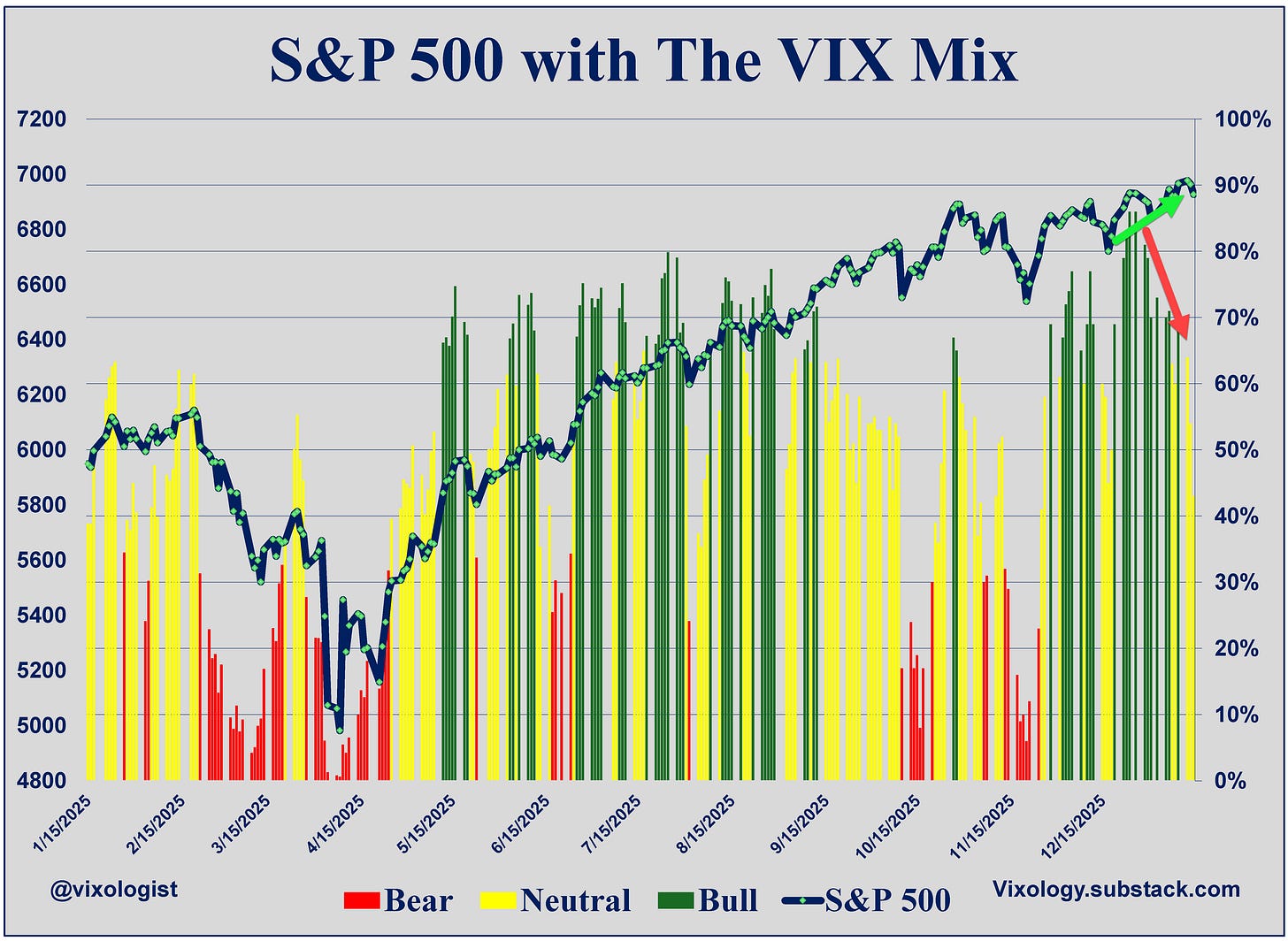

We’ve pointed out the divergence between a rising S&P 500 and the declining VIX Mix. We’ve been careful to note that a bearish divergence doesn’t always result in a market correction. But we’ve also seen bullish components drop from 15 on 12/24 to just two yesterday while the bearish count climbed from zero to six.

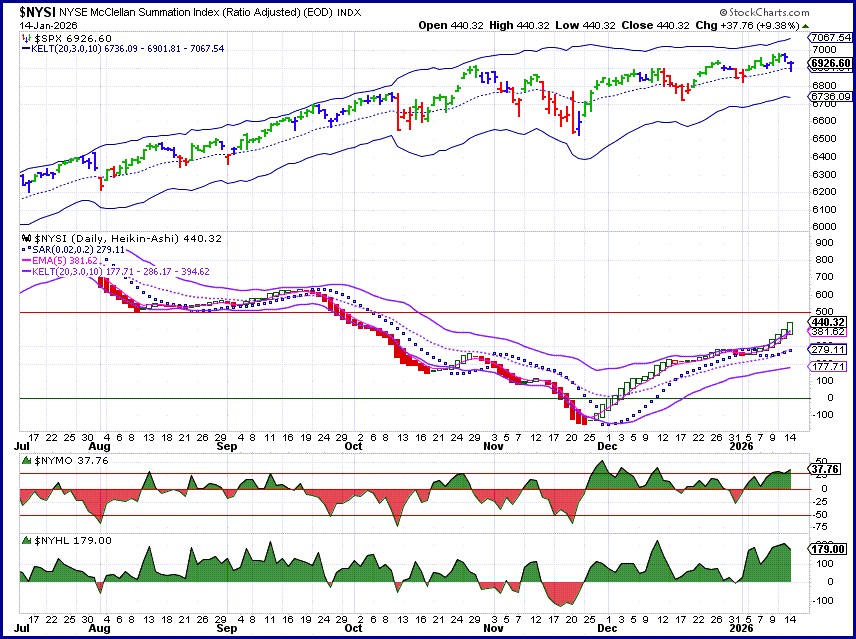

On the other hand, here’s a tally of some bullish sightings from yesterday. With SPX down 53 bps and the Naz Composite off a full 1%, the small cap Russell 2000 finished 70 bps higher and the equal weight SPX (RSP) was up 46 bps. In addition, new highs outpaced new lows both for the 52-week and monthly counts that we track. And the McClellan Summation Indices for both NYSE and Nasdaq have been improving, as shown below.

So, what the !*^!? To borrow another blues reference, I would say we are standing at a crossroads. The VIX Mix is telling us that investors have grown concerned about the sustainability of the recent strength in equity markets. But those markets are showing strength that has moved on from the Mag 7 and positive breadth is almost always a good sign.

Investors have been driving with one foot on the brakes (weaker readings for the VIX Mix). But a diversified portfolio (especially one with non-US exposure) has been holding up well. Equity futures are looking good this morning in a continuation of the rally that closed yesterday’s action. What if that foot moves from the brake pedal to the gas? Let me know what you think!

Excellent breakdown of the current market divergence. The crossroads framing is spot on becuase it captures how the VIX Mix fear signal hasnt translated to actual weakness in breadth metrics yet. I've seen similar setups in early 2023 where defensive positioning got expensive right before rotation accelerated. The McClellan improvements alongside small cap strength suggest institutional money is quietly hedging rather than exiting, which could flip quick if data cooperates.

I expected that weakness to occur. Here is a screenshot of my custom indicator showing it’s value from Jan. 13, it pointed to a drop which then actually occurred the next day (yesterday). I also wrote that yesterday could be the low and so far we are currently in the green today, potentially confirming that low.

https://substack.com/@stockanalysispro/note/c-199733647