Almost Like It Never Happened

Another short chapter from "Make Volatility Great Again"

I suspect that a large number of market participants finished yesterday with a massive case of whipsaw. Tuesday sounded like REM (It’s the End of the World as We Know It) and yesterday was definitely Nevermind (take your pick of the Nirvana album, a very forgettable single from the Red Hot Chili Peppers or this techno poetry from Leonard Cohen).

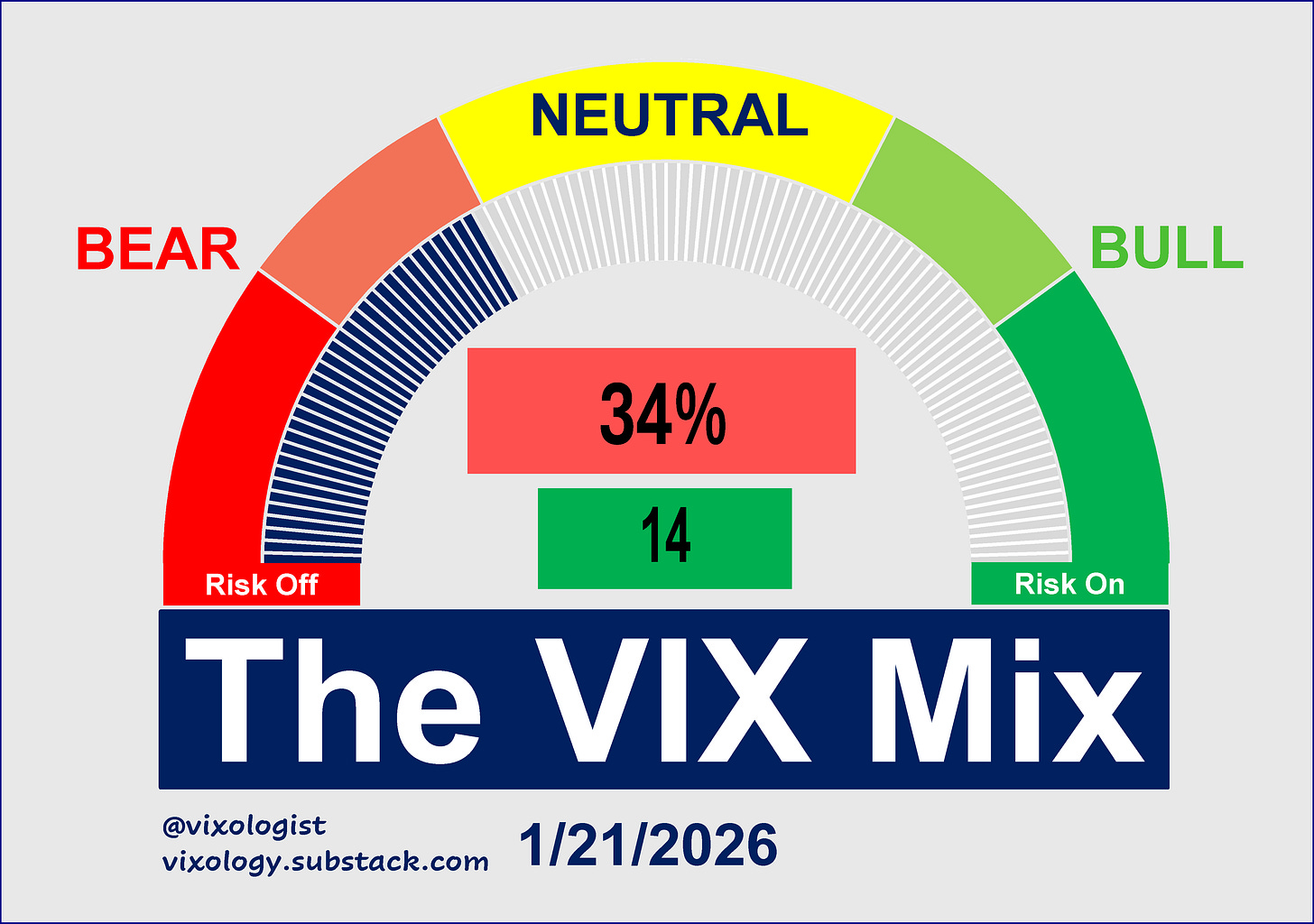

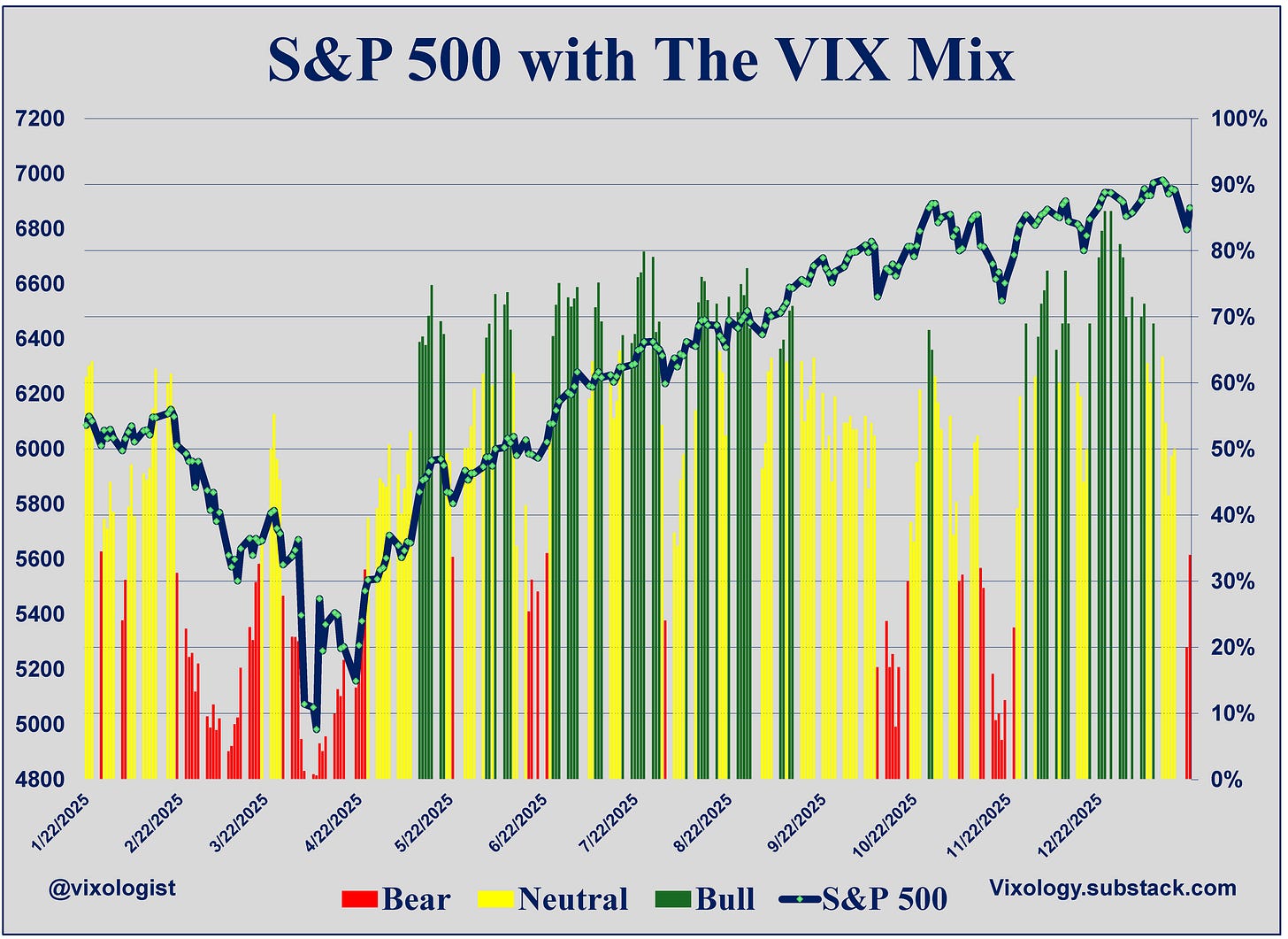

Whichever sound track you choose, it was a wild couple of days. The VIX Mix plunged 30 points on Tuesday and then rebounded 14 points yesterday. Still mired in the red, but likely to claw its way back into the yellow by today’s close.

Yesterday, we suggested that hedgers were on the right side of the trade. But if that trade was a one-day deal, then monetizing those hedges becomes the name of the game. That can be extremely difficult with a bullish reversal almost as dramatic as the bearish swan dive.

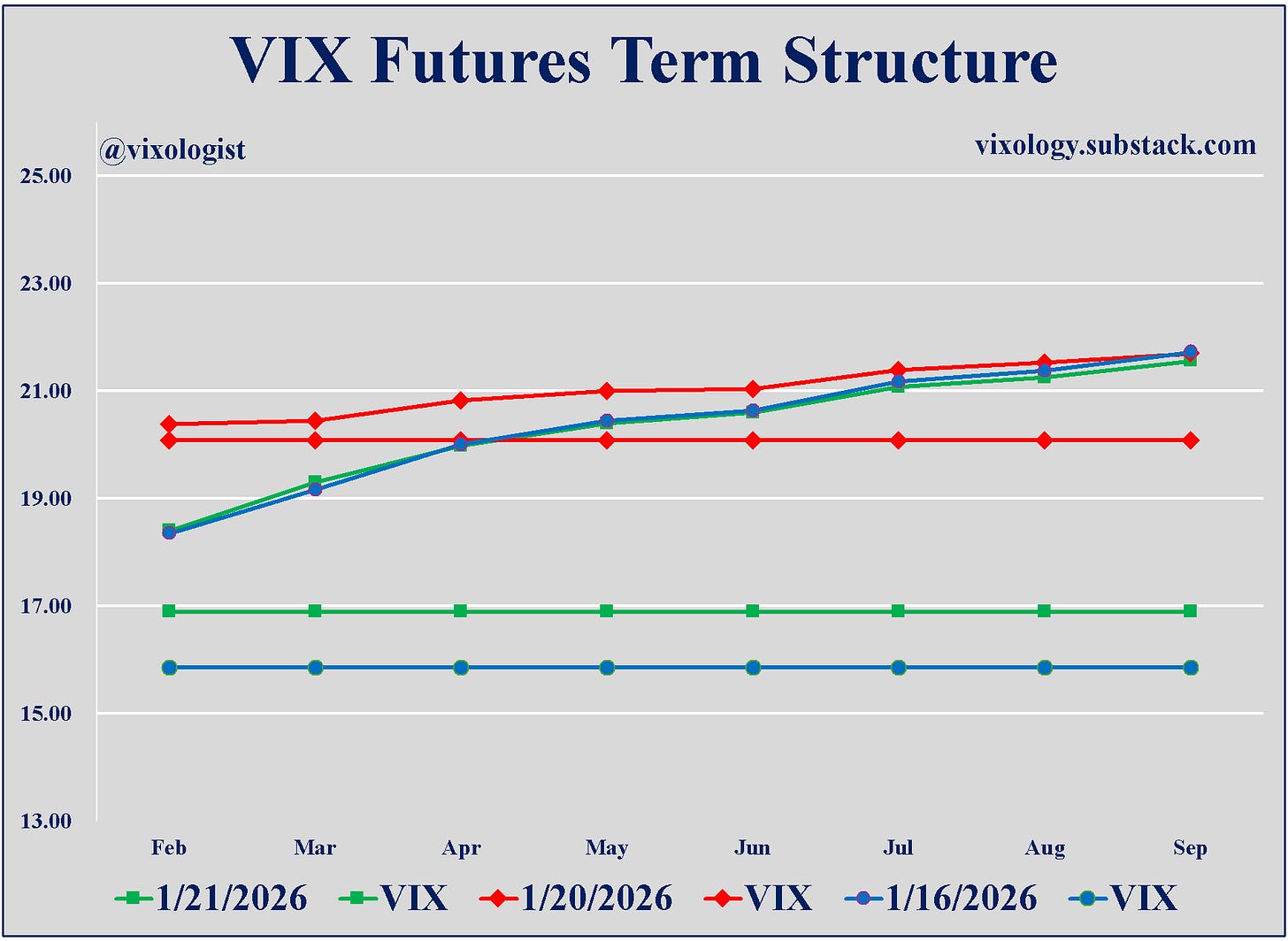

Looking at the VIX futures term structure, we get another picture of “nevermind.” While spot VIX remained elevated relative to last Friday, the futures term structure dropped right back on top of Friday’s curve. That’s an almost eerie example of short-term memory.

With US markets just opening for regular trading hours, it appears we’ll see some additional recovery. Still some wounds out there. SVIX (1x inverse VIX futures aka short vol) is still about 2% below last week’s close after being down as much as 13%. Not that anyone should have been long SVIX coming into the week. Hopefully, the “heads up” we’d been talking about served its purpose. Now we let the dust settle a bit and look to confirm direction.

All content presented here is for informational and educational purposes only. Distribution of any content to any persons other than the recipient is unauthorized. Furthermore, any alteration of content presented here is prohibited. By accepting delivery of this presentation, the reader agrees to the foregoing. Certain information presented herein has been obtained from third-party sources considered to be reliable, but there is no guarantee of completeness or accuracy and it should not be relied upon as such. There is no obligation to update or correct any information presented. Readers should not treat any statement, opinion or viewpoint expressed herein as a solicitation or recommendation to buy or sell any security or follow any investment strategy. This material does not consider the investment objectives, financial situation, or needs of any particular reader. Readers should seek advice from a qualified financial or investment advisor prior to making any investment decision.

Love the music metaphor approach to market analysis! The whipsaw you describe really captures how disorienting these sudden reversels can be for traders. I've noticed that the hardest part isn't picking the direction, but staying calibrated when everyones emotions are swinging just as wildly as the VIX. The Nirvana reference hits diffrently when you realize the market literally said \"nevermind\" to that panic.

One must always be nimble in my business